Accounts Payable days or AP days in 2024: A complete guide

Accounts payable days, also known as AP days or days payable outstanding (DPO), is a financial ratio gauging the average time a business takes to settle invoices with vendors. This metric assesses the effectiveness of the overall accounts payable process.

It is a quantifier of the accounts payable operations of the company – the higher the AP days, the longer the company takes to pay its bills.

An optimum DPO value, like in the Goldilocks story, should neither be too little or too much, but just right.

The rest of this article uses the terms ‘DPO’, ‘days payable outstanding’, ‘accounts payable days’, ‘AP days’, and ‘days in AP’, interchangeably, to mean the same concept.

Read on to know more about accounts payable days and how this measure reflects on the financial health of an enterprise.

What is accounts payable days?

Accounts payable (AP) are a company's short-term cash obligations owed to vendors, suppliers, or creditors - which have not yet been paid.

They are entries in a general ledger as current liabilities because goods or services were bought on credit. The vendor, supplier, or creditor, sends an invoice to the company for the product/service delivered, and the company pays the invoice in due course of time.

Some companies pay invoices as soon as they are received, some pay them later, but within the agreed-upon time period, and some exceed the period, which obviously reflects badly on the company. Sometimes the same company may use different time periods to pay different invoices, depending on the urgency, discounts available, or cash flow problems.

To monitor a company’s trends in paying invoices, the AP department tracks the accounts payable days, or the days payable outstanding.

DPO is a ratio that measures the average number of days an organization takes to pay its bills to suppliers/vendors/creditors.

Looking to automate your manual AP process? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation. Free 7-day Pro Trial included.

How to calculate AP days or DPO?

‘Days in AP’ as accounts payable days is often referred to, is calculated using a simple formula that adds all purchases from suppliers during the measuring time period and then divides it by the accounts payable turnover.

The Accounts Payable Turnover (APT) is the ratio of the total supplier purchases and the average of the accounts payable amount, i.e. the average of the start accounts payable and the end accounts payable balances.

It is given as:

Let's calculate the days in AP of a company for a 30-day month:

Assume that,

- The accounts payable balance at the beginning of the year was $ 100,000

- The accounts payable balance at the end of the year was $150,000

- Purchases were made on credit, to the tune of $1,000,000

the Accounts Payable Turnover is calculated to be:

DPO is then calculated by dividing the number of days by the APT:

The company’s days in AP is therefore 3.75 days.

It must be remembered that cash payments to vendors must be excluded from this equation and only credit purchases must be included.

Why calculate accounts payable days?

The days payable outstanding is like the scores in a single core subject in an educational program. By itself, it is not sufficient to predict or assess the financial health of the company.

However, when combined with other Key Performance Indicators (KPI) like cost per invoice processed, percent of invoice exceptions, and number of invoices/employee/day, it can be a powerful report of the financial health of an organization.

It is intuitive to suppose that a low value of accounts payable days is a good thing – in that, it indicates that a company pays its suppliers on time. This may not always be the case.

There is an optimum value of accounts payable days that depends on the industry/domain to which the company belongs. A DPO below this number could indicate that the company does not have good credit terms compared to its competitors, or is not fully utilizing the credit period offered by creditors.

Similarly a high value of accounts payable days appears to indicate that the company is having trouble meeting its commitments on time. It could also mean that there is working capital for a longer time, and that the company has good credit standing, which allows it to pay invoices later.

However, delaying payments can result in deterioration of relationships with the vendors, suppliers, or creditors, which may in turn affect the credit rating of the company.

The optimum accounts payable days depends on the company’s working style, financial background, the industry to which it belongs.

There is no objective “good” or “bad” days payable outstanding value. Monitoring DPO and maintaining it at levels comparable to other companies in the field helps in achieving the right balance between cash flow and vendor satisfaction.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

How to improve your AP days?

The sweet spot of days payable outstanding is achieved by optimizing the accounts payable process.

The maintenance of an optimal DPO depends upon the seamless coordination between the Accounts Payable team and purchase departments and senior management responsible for payment approvals. Such collaboration ensures that invoices are received and processed in a timely fashion, optimizes payables and frees up working capital to fuel growth.

Another way to optimize the DPO is assessing one’s own payment terms vis-à-vis the vendor’s. A mismatch between the customer’s payment terms and that of the vendor may lead to ambiguity in payment due dates.

For example, if the customer’s payment term is 30 days, and that of the vendor is 15, there may be delays in payment. Matching one’s own payment terms with that of the vendor, or negotiating with the vendor to match their terms with the company’s can help optimize cashflow and by extension the DPO metric.

The above condition necessitates good communication between the vendor and client. Good supplier communication is imperative to avoid misunderstandings regarding payments and payment terms. Ineffective collaboration can erode supplier confidence which can have damaging effects on the entire accounts payable process, and thereby the DPO.

Good planning and forecasting can help in optimizing the accounts payable days. This in turn depends on good data management and processing, and the use of forecast specialists and software so that the company has a handle on working capital at all times. Knowing the status of working capital and immediate and extended financial background of the company can help in deciding the timeline for payment of invoices, which optimizes DPO.

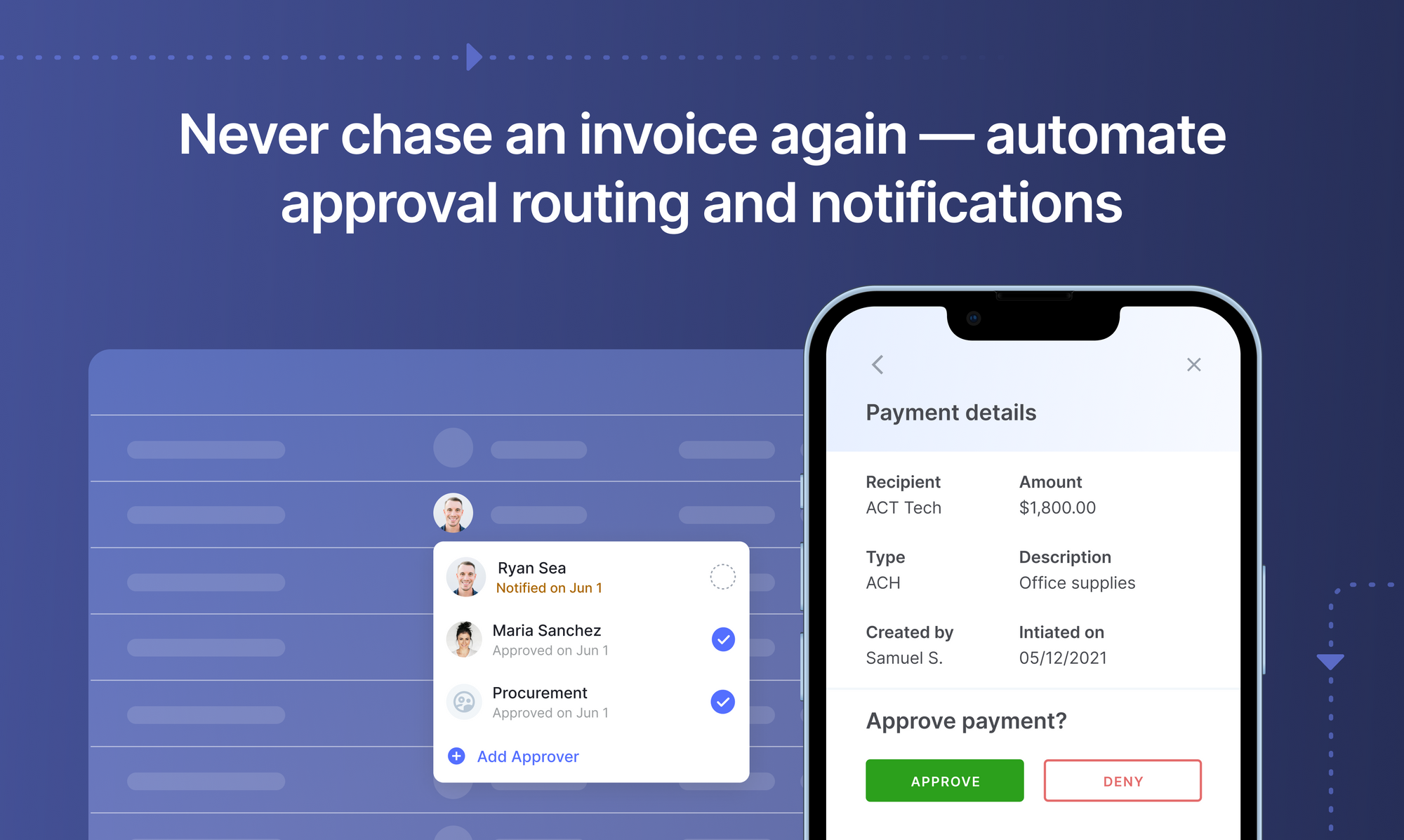

All of the above conditions necessitate optimization of the entire accounts payable process A fail-proof way to streamline the accounts payable process is to automate all or some parts of it. Automated invoice processing software can avoid many of the errors that may occur in the invoice processing workflow, and thereby help maintain a healthy value of days payable outstanding.

Optimizing DPO with AP automation

One proven approach to streamlining the AP process is the automation of the AP workflow. Automation serves the following purposes:

- Eliminates paper clutter, thereby reducing processing time and error rates

- Links POs and invoices with electronic payments, which presents the full picture of the accounts payable cycle

- Helps improve vendor management & prevent vendor fraud

- Enables hassle-free three-way matching

- Allows integration of the Accounts Payable process with other core business systems such as ERPs and CRMs

- Allows setting up of multiple checkpoints in the accounting payable cycle to avoid overspending or unnecessary purchases

- Warnings and alarms can be set when discrepancies are detected at any stage of the accounts payable workflow

- Allows for setting up payment deadlines

- Enables generation of periodic reports to understand the spending patterns of the company and prepare for audits and taxation

A fully automated AP process includes:

- Invoice digitization: Invoices in various formats must first be digitized into a standard format. Since each invoice holds key data that are used in accounting resource planning, and decision-making within the business, accuracy in data extraction is essential. The data that’s read from invoices are usually then transferred to ERP, accounting, or data analytics platforms used by the company for subsequent processing.

- Automated validation: Automated three-way matching can capture pertinent data from invoices, POs, and receipts and auto-process them in a way that mimics the human mind. Of them, the AI-enabled processing can also compare and match records and make decisions such as passing the transaction, flagging errors or raising exceptions.

- Automated exception handling: When errors are flagged or exceptions raised, the invoice is immediately routed to appropriate personnel who can fix the errors. This can reduce time delays that are associated with manual error handling.

- Automated approvals: After matching and validation, the invoices are automatically transmitted to the appropriate personnel for approval. Application of digital signatures and approvals in digital form can prevent delays.

- Payment processing: After approval, the automated system forwards the invoice to the finance team for payment processing after which the transaction is closed and the data is archived.

According to a recent survey, here are the top automated invoice processing solutions that many companies would like to implement:

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

Take away

Accounts payable activities that include coding, assessing, authorizing, and paying invoices decide the financial and administrative health of enterprises.

The AP days is a key indicator of the efficiency of the AP activities of a company. It is not an absolute metric, and must be viewed relative to the industry.

As part of the trifecta of the cash cycle, that includes, Days Sales Outstanding and Days in Inventory, the DPO is a useful indicator of how much cash a business must have to sustain itself.

Maintaining optimum DPO requires streamlining the AP process. Besides maintaining operational order, the use of automation in AP processes can help companies maintain optimum DPO and, thereby, sufficient working capital to run the show effectively. AI-supported AP automation software like Nanonets can be part of the larger automation ensemble to help your company maintain optimum DPO to stay competitive and efficient.

Each accounts payable group's responsibilities contribute to improving the payments process and ensuring that money is paid solely on legal and precise bills and invoices. A skilled and well-managed AP staff can save your company significant time and expenses.

.png)

.png)

.png)

.png)