Best Balance sheet reconciliation Software

Imagine you're a financial manager at a bustling enterprise, entrusted with the responsibility of ensuring the accuracy and integrity of your company's financial records. As you look into the labyrinth of spreadsheets and ledger entries, you stumble upon discrepancies in your balance sheet—a familiar scenario for many finance professionals. You know that untangling this web of numbers is not just about ensuring compliance; it's about safeguarding the financial health and reputation of your organization.

In modern finance, where transactions occur at breakneck speed and fin-data volumes swell exponentially, the traditional methods of manual reconciliation are increasingly becoming inadequate. This is where balance sheet reconciliation software steps in to ensure speed, efficiency and accuracy in financial management.

Why Do We Need Balance Sheet Reconciliation Software?

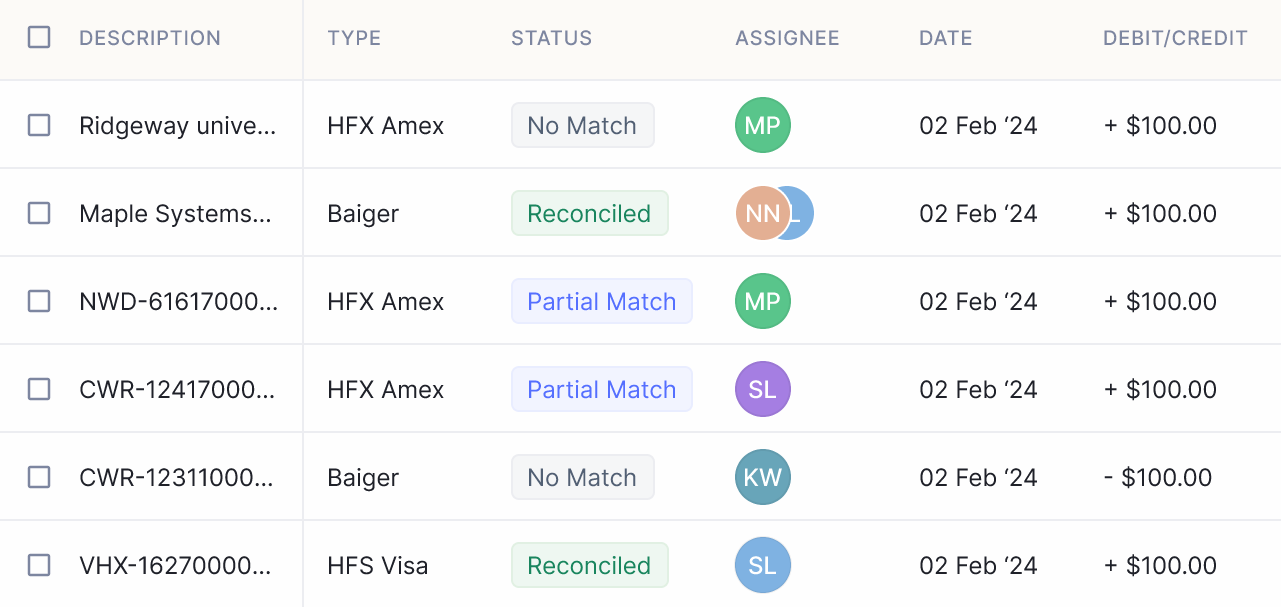

Balance sheet reconciliation software, also known as accounts reconciliation software, is a specialized tool designed to streamline and automate the process of reconciling balance sheet accounts within an organization's financial system. This software enables finance professionals to compare and match transactions and balances recorded in the general ledger with external sources such as bank statements, vendor invoices, and other financial documents. It leverages advanced algorithms and artificial intelligence to identify discrepancies and errors, allowing finance teams to promptly investigate and resolve issues.

Balance sheet reconciliation software is not just a luxury but a necessity in today's fast-paced and highly regulated business environment, for the following reasons.

- Complexity of Financial Transactions: With businesses expanding globally and engaging in a myriad of financial transactions, the complexity of reconciling accounts has skyrocketed. From multiple currencies to diverse payment methods, the sheer volume and variety of transactions make manual reconciliation prone to errors and delays.

- Time and Resource Constraints: Traditional methods of reconciling balance sheets involve extensive manual labor, consuming valuable time and resources. Human errors are not uncommon, and the time spent rectifying these mistakes could be better utilized for strategic financial analysis and decision-making.

- Regulatory Compliance: Compliance with regulatory standards such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) is non-negotiable for businesses. Balance sheet reconciliation software offers built-in compliance checks and audit trails, ensuring adherence to regulatory requirements and mitigating the risk of non-compliance penalties.

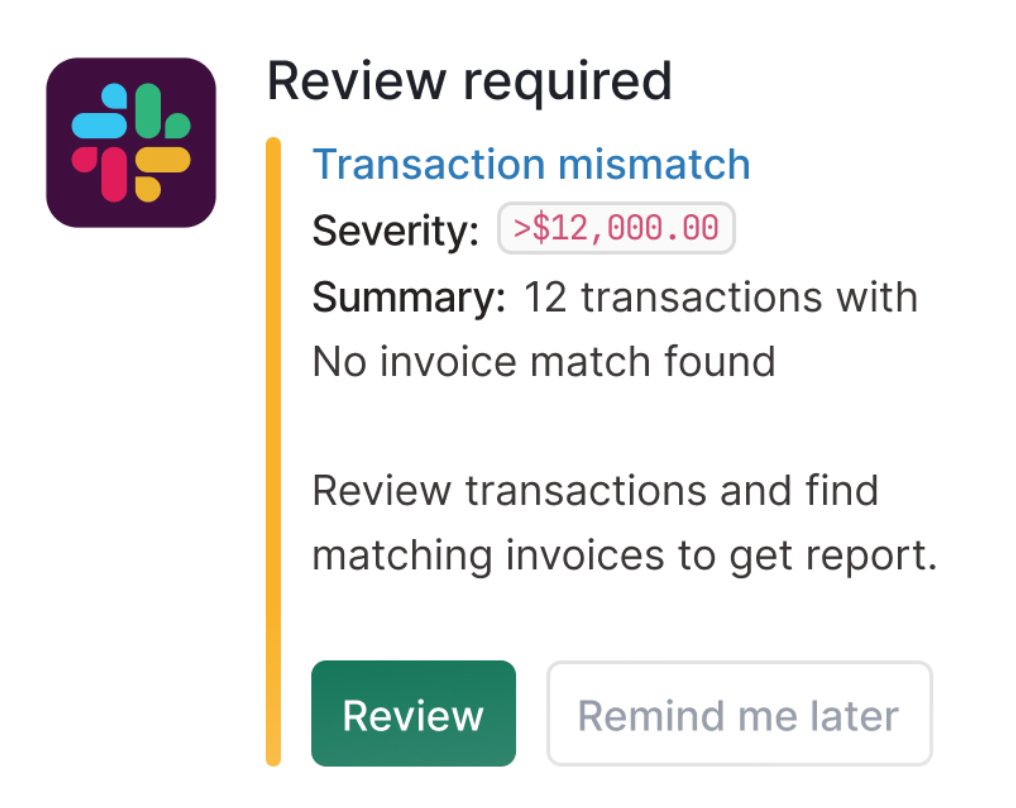

- Risk Management: Accurate and timely reconciliation is critical for effective risk management. Discrepancies in balance sheets can signal underlying issues such as fraud, mismanagement, or operational inefficiencies. By automating the reconciliation process, software solutions enable real-time identification and resolution of discrepancies, thereby enhancing risk mitigation efforts.

- Enhanced Efficiency and Accuracy: Balance sheet reconciliation software leverages advanced algorithms and automation capabilities to streamline the reconciliation process. By eliminating manual data entry and automating routine tasks, these software solutions reduce the likelihood of errors and enable finance teams to focus on value-added activities.

Best Balance Sheet Reconciliation Software

Find below a gist of the best Balance Sheet Reconciliation Software available in the market today

What to look for in Balance Sheet Reconciliation Software?

When searching for the best balance sheet reconciliation software for your organization, the following key factors should be considered:

- Automation Capabilities: Look for software that offers advanced automation features to streamline the reconciliation process. Automated matching, data extraction, and variance analysis can significantly reduce manual effort and errors.

- Integration with Existing Systems: Ensure that the software integrates seamlessly with your organization's existing financial systems, such as ERP (Enterprise Resource Planning) or accounting software. This facilitates data flow and minimizes disruptions to your current workflows.

- Customization Options: Choose a solution that allows for customization to meet your specific reconciliation needs. Customizable workflows, reporting templates, and user permissions ensure that the software aligns with your unique business requirements.

- Accuracy and Data Integrity: Accuracy is paramount in balance sheet reconciliation. Look for software with built-in validation checks, audit trails, and data validation features to maintain data integrity and ensure compliance with regulatory standards.

- Ease of Use and Accessibility: User-friendly interface and accessibility across devices enable finance teams to easily navigate the software and collaborate effectively. Intuitive dashboards, drag-and-drop functionality, and mobile access enhance user experience.

- Scalability and Flexibility: Choose a software solution that can scale with your organization's growth and adapt to changing business needs. Scalable pricing plans, flexible deployment options (cloud-based or on-premise), and modular features support scalability and flexibility.

- Security and Compliance: Prioritize software solutions that adhere to industry-standard security protocols and compliance requirements. Look for features such as role-based access controls, data encryption, and compliance certifications (e.g., SOC 2, GDPR) to safeguard sensitive financial data.

- Customer Support and Training: Evaluate the level of customer support and training provided by the software vendor. Responsive customer support, comprehensive documentation, and training resources ensure that your team can maximize the benefits of the software.

In addition to the factors mentioned above, it's crucial to conduct due diligence and thorough research into various software options. Reading user reviews, consulting industry experts, and requesting demos or trials can provide valuable insights into the strengths, weaknesses, and suitability of each software solution for your organization's specific requirements.

Nanonets – Your Best Choice for Balance Sheet Reconciliation

Nanonets is a top choice for balance sheet reconciliation software. Here's why:

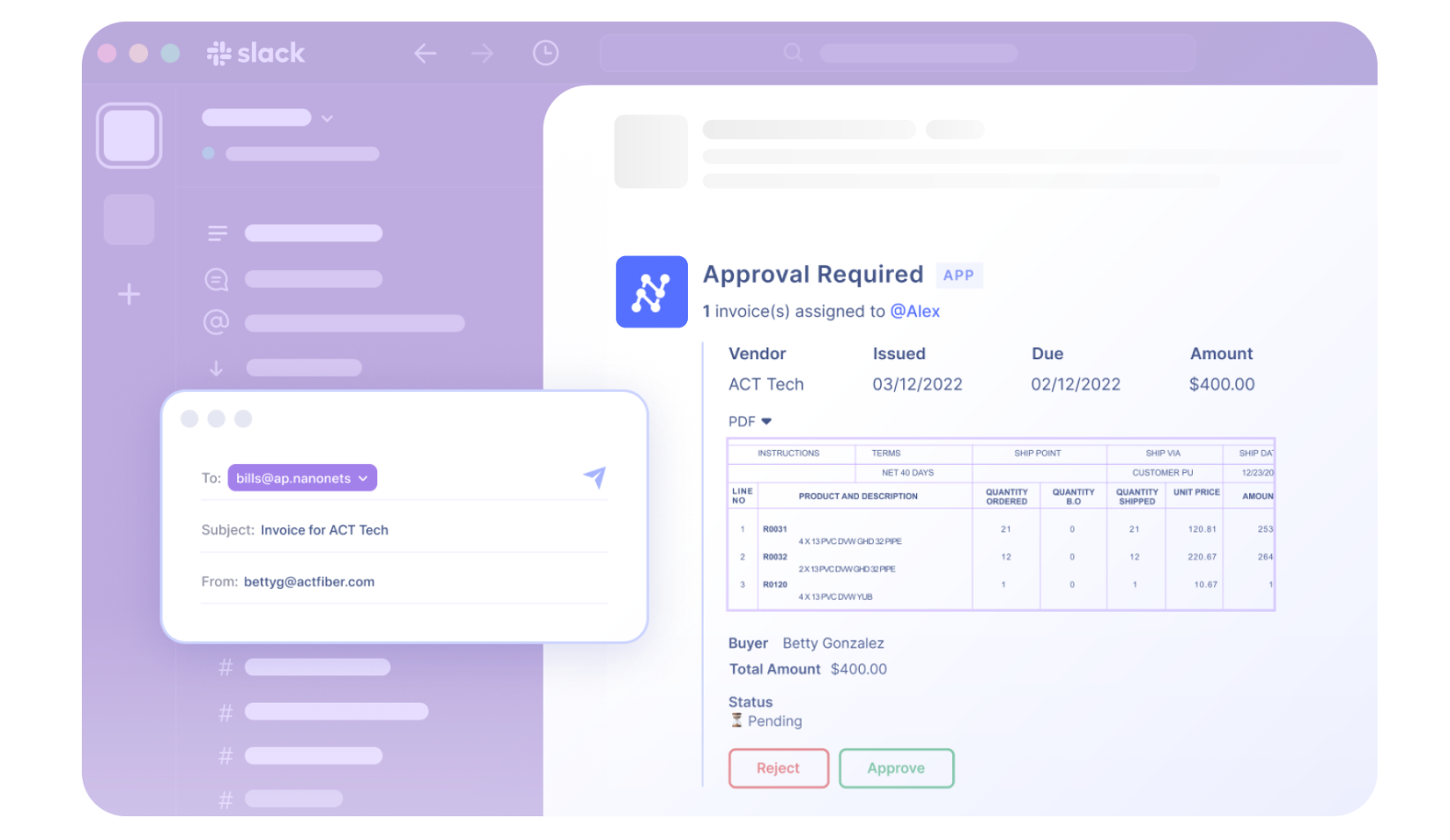

- Advanced Automation: Nanonets harnesses the power of AI and machine learning to automate the reconciliation process efficiently. Its auto-extraction capabilities ensure seamless data retrieval from various sources, while AI-driven matching algorithms accurately reconcile transactions, reducing manual effort and errors.

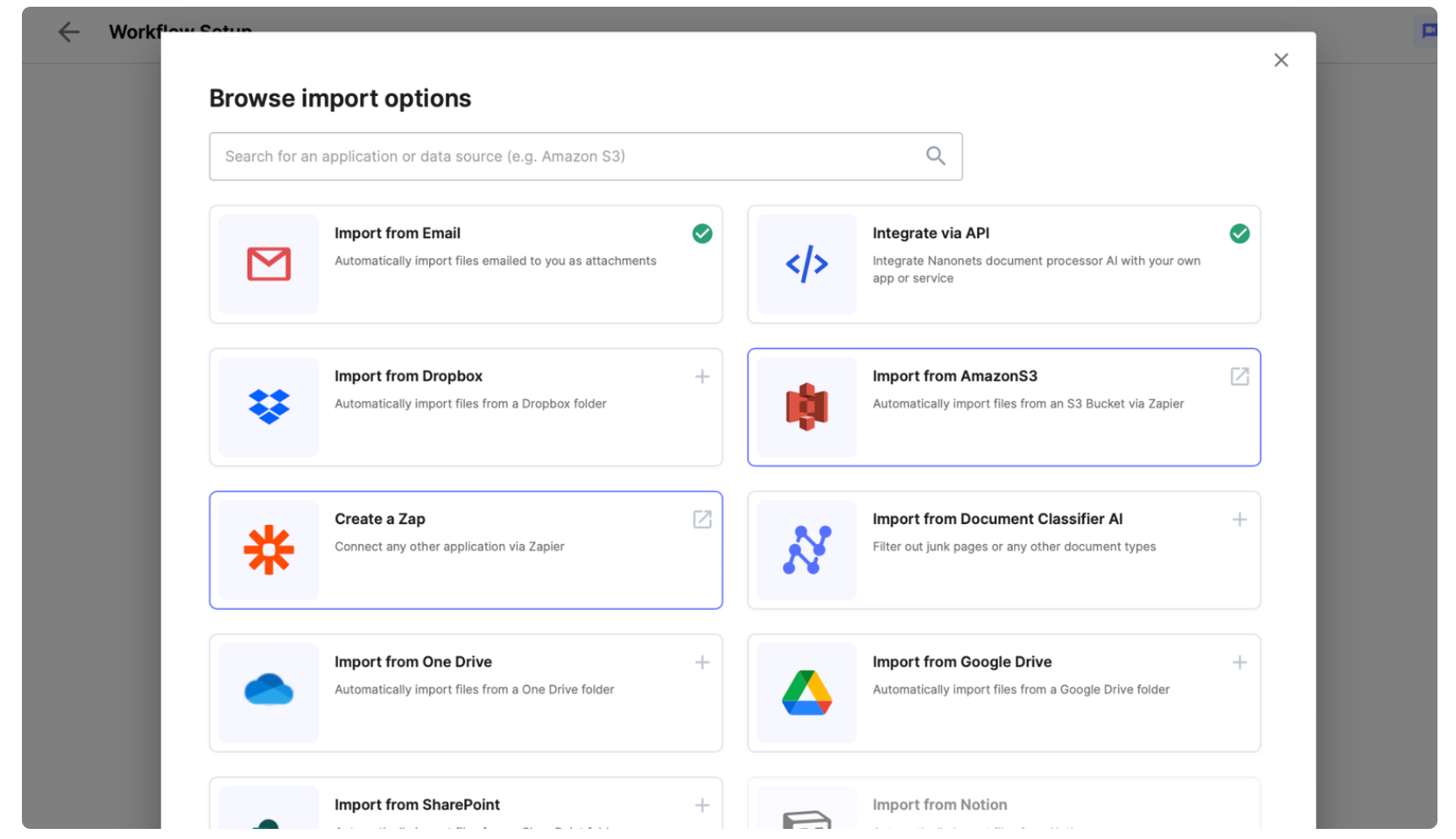

- Versatile Integration: Nanonets seamlessly integrates with existing accounting systems and data sources, enabling smooth data flow and synchronization. Whether it's ACH payment processing, accounting integration, or API connections, Nanonets offers versatile integration options to fit your organization's needs.

- Ease of Use: Nanonets boasts an intuitive interface and user-friendly design, making it easy for finance professionals to navigate and utilize its features effectively. From customizable workflows to collaborative tools, Nanonets prioritizes simplicity without compromising functionality.

- Scalability: Whether you're a small startup or a large enterprise, Nanonets scales effortlessly to accommodate your organization's growth. Its flexible pricing plans and modular features ensure scalability without overburdening your budget or IT infrastructure.

- Accuracy and Reliability: Nanonets prioritizes accuracy and reliability in balance sheet reconciliation. With built-in audit trails, validation checks, and compliance management features, Nanonets ensures data integrity and regulatory compliance, giving you peace of mind.

- Exceptional Customer Support: Nanonets is backed by a dedicated customer support team committed to providing timely assistance and resolving any issues promptly. From implementation to ongoing support, Nanonets ensures a smooth and seamless experience for its users.

- Positive User Feedback: User reviews and ratings on platforms like Capterra consistently highlight Nanonets' effectiveness, ease of use, and value for money. With high scores across various categories, Nanonets earns the trust and satisfaction of its users.

Take Away

As organizations navigate through the complexities of modern business transactions, the need for automation, accuracy, and efficiency becomes paramount. Bank balance reconciliation software streamlines the reconciliation process and enhances data integrity, regulatory compliance, and risk management. By leveraging advanced technologies such as artificial intelligence, machine learning, and automation, these software solutions empower finance professionals to reconcile accounts with speed and precision. Seamless integration with existing financial systems, customizable workflows, and intuitive interfaces ensure a seamless user experience, regardless of the organization's size or complexity.

As demonstrated by the diverse range of software options available, from Nanonets to QuickBooks, organizations have the opportunity to choose a solution that best aligns with their specific requirements and objectives. By conducting due research, considering user reviews, and evaluating features, organizations can select the ideal bank balance reconciliation software to optimize their financial processes and achieve sustainable growth.