Automated Clearing House (ACH) payments have become increasingly popular among growing businesses - for their faster processing times, lower fees, and reduced risk of fraud. However, managing ACH payments can be a challenging task for AP teams, especially when dealing with multiple vendors and payment preferences.

In this article, we’ll provide a detailed look at how ACH payments work, why they’re better than checks or cards, and how to get started with ACH.

How do ACH payments work?

ACH payments are electronic fund transfers used to move money between bank accounts in the United States.

To initiate an ACH payment, the receiver must first authorize the transaction. The sender then enters payment details into their bank's ACH system, which sends the payment to the ACH network for processing. The ACH network checks the transaction and sends it to the receiver's bank for deposit. Once processed, funds are deposited into the receiver's account, which takes 1-2 business days to complete.

ACH payments are commonly used for recurring payments such as vendor payments, payroll, mortgage, and utility bills. They're also used for one-time payments such as online purchases, tax refunds, and charitable donations.

ACH payments are considered safe and secure, with the ACH network ensuring that the sender has enough funds to cover the payment and that the receiver's account is valid. ACH payments are faster than traditional paper checks and offer cost savings for businesses compared to credit and debit card processing fees.

Looking to automate your manual AP process? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Benefits of ACH payments for vendors

ACH payments are an electronic alternative to paper checks that offer several benefits to vendors:

- Convenience: ACH payments are easier to process compared to faster than checks, saving on manual work for your AP team.

- Lower Costs: ACH payments have lower fees than card payments, which can help save significant money on transaction costs. Card fees typically vary from 2.5% to 5%, while ACH costs around $0.5 per transaction.

- Better Tracking: ACH payments are less prone to fraud than checks, which can help avoid losses due to payment fraud.

- Works Globally: Along with domestic ACH inside the United States, the ACH network also interfaces with payment systems in other countries like Canada or the UK.

How to set up ACH payments for vendors

Getting started with ACH payments to your vendors can be a simple 2-step process:

- Vendor Onboarding - Getting an ACH confirmation and banking information from your vendor.

- ACH Setup - Connecting your bank account to the ACH payment processor of choice.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

How should you select an ACH payment processor?

There are a few factors that should be kept in mind when selecting an ACH payment platform for SMBs (small-to-medium businesses):

- Transaction fees: ACH payments are typically a fixed-fee type of payment, where you will be paying a fixed transaction fee regardless of the amount being transferred. Multiple service providers provide competitive prices - look for something that’s below $0.3 per transaction as the sweet spot.

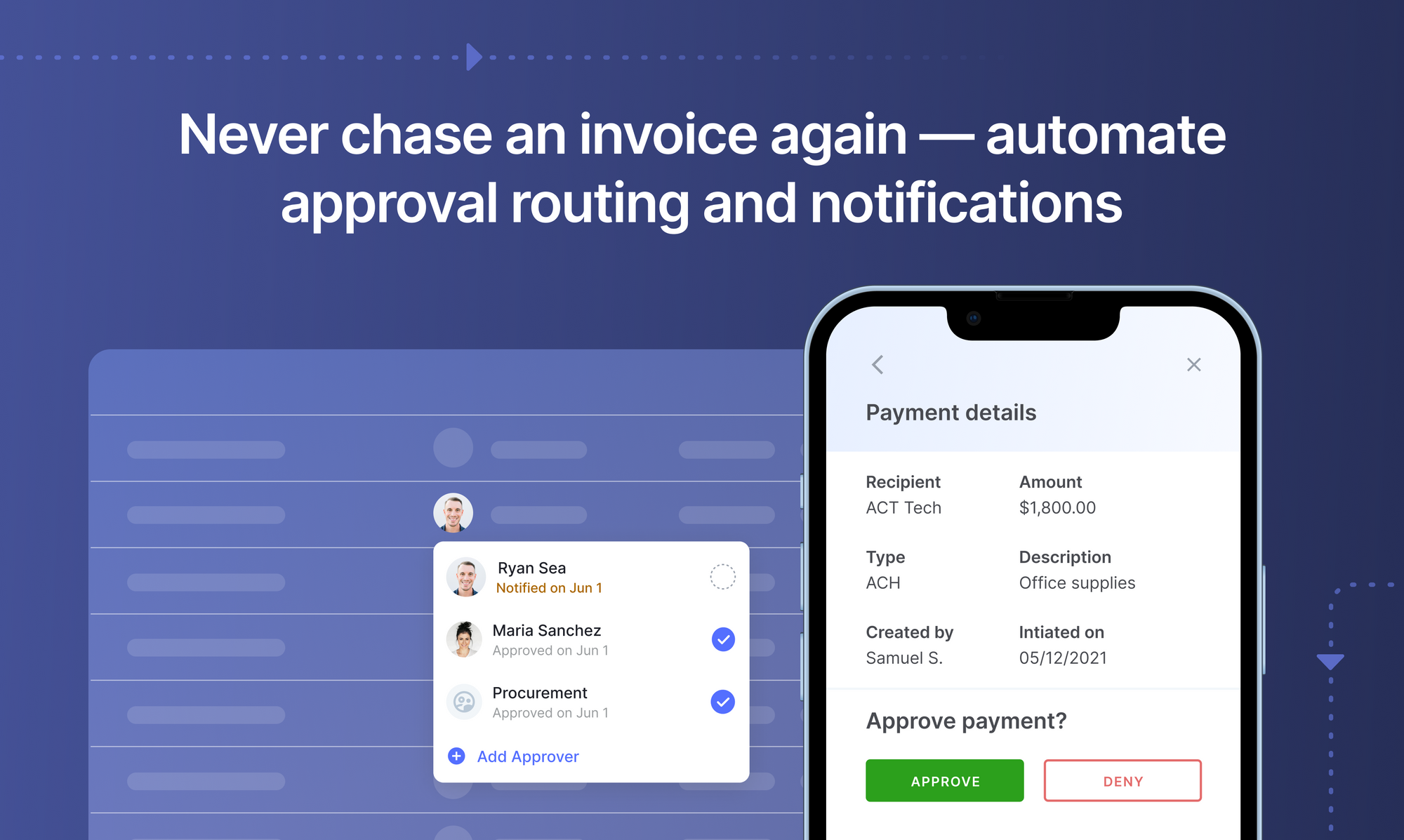

- Integration capabilities: Your ACH payments should ultimately link back to your invoices, and should be visible to your larger team for approvals and supporting documentation. Your payments data should also link to your vendor management platform.

- Payment options: Yes, this is counterintuitive - why would you want more payment options when you’re choosing to pay via ACH? However, the reality of business today is that different vendors will have different preferences, and may choose ACH/checks/wires/card payments as their preferred payment method. Having a solution that covers all these needs is usually the best practice here.

Getting started with ACH for vendors

For mid-market businesses, integrating their payment platform with accounting and AP processes is usually the best practice. This allows for significant improvement in key AP metrics and also reduces costs as revenue scales up.

For example, at Nanonets, we’ve made vendor ACH payments extremely simple and straightforward. Our platform achieves two key goals:

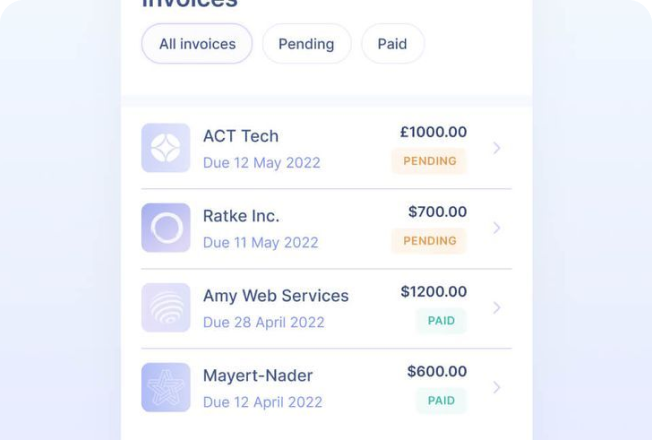

- Make any of ACH/card/check/wire payments to your vendors

- Automatically link to your invoices and approval workflows with transaction-level reconciliation

Get on call with one of our experts, and we can have you up and running within 1-2 business days.

Conclusion

Automated ACH payments offer several benefits to both SMBs and vendors, but managing payments along with Accounts Payable can be a challenging task for businesses. Fortunately, Nanonets offers a solution for automated ACH payments that can help customers save time and money.

With Nanonets, customers can automate payment reconciliation, support multiple payment methods, and receive real-time payment status updates. Try it today and experience the benefits of automated payment processing.

.png)

.png)

.png)

.png)