A guide to Accounts Payable with OCR Payments in 2024

What is Accounts Payable?

Accounts payable (AP) refers to the amount of money a company owes to its vendors, suppliers, and creditors for goods and services received but not yet paid for. It is a liability on the company's balance sheet, representing the company's obligation to make payments to its creditors.

The accounts payable process typically begins when a company receives an invoice from a vendor or supplier for goods or services that have been delivered. The invoice typically includes the quantity, price, and description of the goods or services received. The company then verifies the invoice to ensure that it is accurate and matches the goods or services received. This process may involve comparing the invoice to purchase orders, receipts, or other documentation to ensure that the invoice is legitimate.

Once the invoice has been verified, the company records the amount owed in its accounts payable ledger. This ledger tracks all outstanding invoices and the amount owed to each vendor or supplier. The company then makes payment to the vendor or supplier when the invoice is due, usually within a specified period, known as the payment term. The payment term is usually negotiated between the company and the vendor or supplier and can range from a few days to several months.

Accounts payable is an important part of a company's financial management and cash flow. By properly managing trade payable or accounts payable, a company can ensure that it has sufficient cash on hand to pay its bills on time and take advantage of discounts for early payment. It also helps companies to maintain good relationships with their vendors and suppliers by paying them on time and in full.

The Accounts Payable Process

Here are the steps of a typical accounts payable workflow in order -

- Purchase Order (PO) Creation: This is the first step in the accounts payable workflow. The purchasing department creates a purchase order for goods or services to be acquired from a vendor.

- Goods or Services Received: After the purchase order is created, the vendor sends the goods or provides the services. The receiving department confirms the receipt of goods or services and validates against the PO.

- Invoice Creation: Once the goods or services have been received, the vendor creates an invoice for the payment. The invoice typically includes details such as the purchase order number, date, description of goods/services, price, and payment terms.

- Invoice Approval: The invoice is then sent to the appropriate person or department for approval. This can include the department manager, budget manager, or other authorized personnel. Once approved, the invoice is ready for processing.

- Invoice Processing: The accounts payable department then processes the invoice. This involves verifying the accuracy of the invoice, checking for any discrepancies or errors, and entering the information into the accounting system.

- Payment Authorization: Once the invoice has been processed, the payment is authorized. This can include the department manager, budget manager, or other authorized personnel. The payment authorization process can involve verifying that there are available funds for payment.

- Payment Processing: Once payment has been authorized, the accounts payable department processes the payment. This typically involves printing a check or initiating an electronic payment.

- Payment Reconciliation: After the payment has been processed, the accounts payable department reconciles the payment with the original invoice and verifies that the payment was made in the correct amount.

- Vendor Account Reconciliation: The accounts payable department periodically reconciles vendor accounts to ensure that all invoices have been paid and there are no outstanding balances.

- Reporting and Analysis: Finally, the accounts payable department generates reports to track payments and analyze vendor activity. This can include vendor spend reports, payment history reports, and other financial analyses.

Looking to automate Accounts Payable using OCR? Look no further! Try Nanonets Automated Accounts Payable OCR Workflows for free.

What is OCR Payment?

Optical Character Recognition (OCR) payment is the electronic receipt of payments from customers. Each OCR payment includes a Customer Identification (KID) reference for tracking.

Process Overview:

- Installation: Electronic banking software must be installed on your computer.

- Agreement: A formal agreement with the bank is necessary to utilize the OCR payment process.

This method enhances efficiency in payment handling, offering a systematic approach with customer identification for tracking and reconciliation.

OCR for Accounts Payable

Optical Character Recognition (OCR) technology can be used to automate several steps in the accounts payable workflow, bringing numerous benefits to organizations. OCR technology allows computers to extract and interpret text data from scanned images, PDFs, or other electronic documents, which can be used to automate data entry and other manual tasks involved in the accounts payable process.

Here are some ways that using OCR in the accounts payable workflow can help automate the process and bring benefits:

- Faster Processing: OCR technology can extract data from invoices or purchase orders much faster than humans can. This allows organizations to process invoices and purchase orders more quickly, reducing the time it takes to complete the accounts payable workflow.

- Reduced Errors: Manual data entry is prone to errors, which can lead to inaccuracies in the accounts payable process. OCR technology reduces the risk of errors by automatically extracting data from invoices and purchase orders and inputting that data into the appropriate fields in the accounting system.

- Lower Costs: Automating the accounts payable process using OCR technology can help organizations save money by reducing the need for manual labor. This can include reducing the number of staff needed to perform data entry tasks, as well as reducing the number of errors and associated costs.

- Improved Data Accuracy: OCR technology can help improve data accuracy by eliminating human errors that can occur during data entry. This can help ensure that invoices and purchase orders are processed correctly and that payments are made in the correct amount.

- Enhanced Productivity: Automating the accounts payable process using OCR technology can free up staff time to focus on more strategic tasks, such as analyzing data and improving processes. This can help improve overall productivity and efficiency in the accounts payable department.

- Improved Vendor Relationships: By automating the accounts payable process using OCR technology, organizations can process invoices and payments more quickly and accurately, which can help improve relationships with vendors. This can lead to better terms and conditions from vendors and improved supplier relationships.

- Better Cash Flow Management: By automating the accounts payable process using OCR technology, organizations can process invoices and payments more quickly, which can help improve cash flow management. This can help organizations manage their cash flow more effectively, reducing the risk of cash flow problems and improving financial stability.

- Improved Compliance: OCR technology can help improve compliance with regulatory requirements and internal policies by ensuring that invoices and payments are processed accurately and in accordance with established procedures.

Looking to automate Accounts Payable using OCR? Look no further! Try Nanonets Automated Accounts Payable OCR Workflows for free.

Nanonets for Accounts Payable Automation

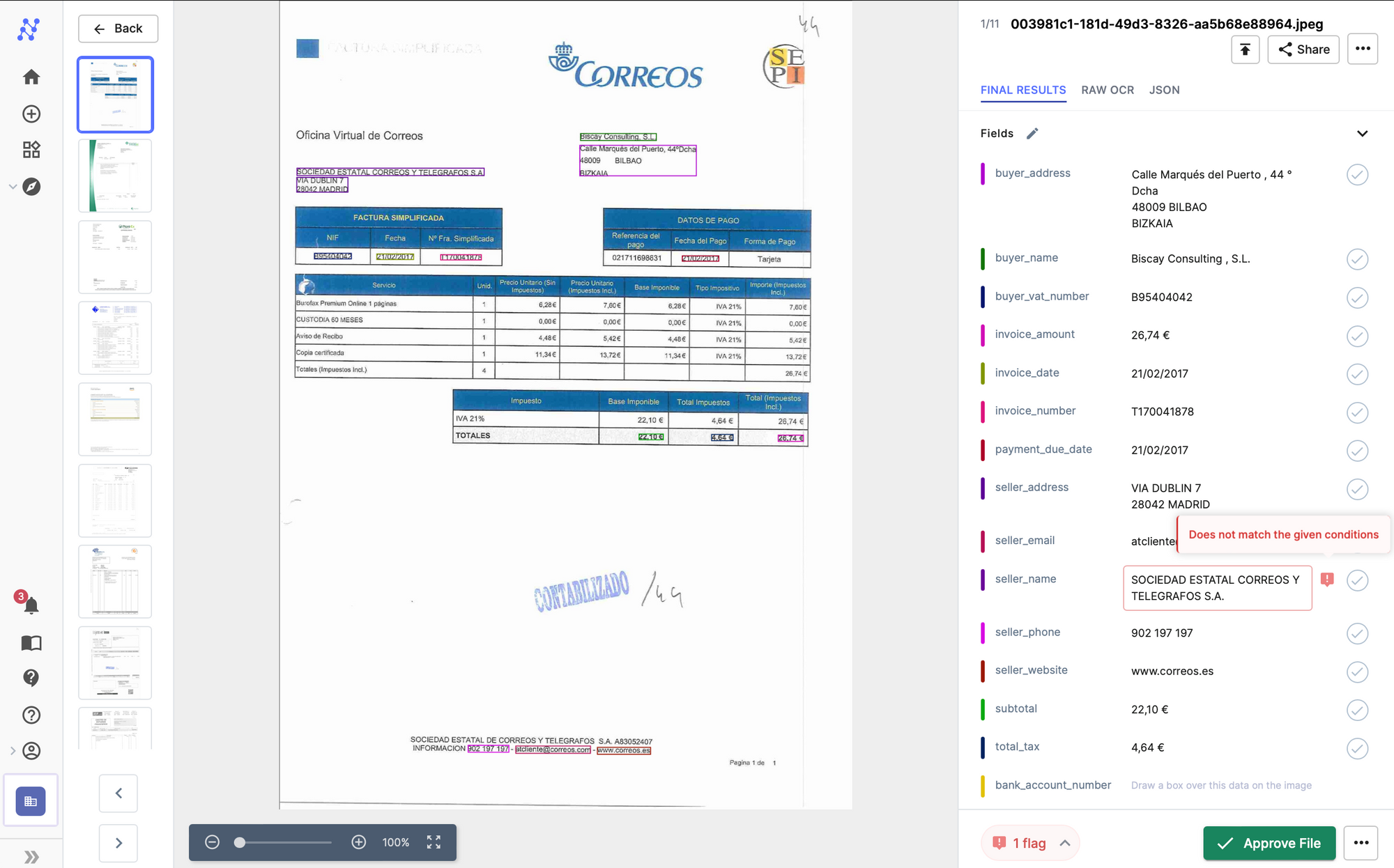

Let us revisit each step of the accounts payable workflow listed in the section above and discuss how Nanonets OCR can help automate processes -

- Purchase Order (PO) Creation: Nanonets can help streamline the purchase order creation process by automating the extraction of data from purchase requisitions or other source documents. Using machine learning algorithms, Nanonets can extract relevant information such as vendor names, item descriptions, and pricing information and input that data into the appropriate fields in a purchase order template.

- Goods or Services Received: Nanonets can help automate the validation of goods or services received against the PO by using image recognition technology. For example, Nanonets can process images of packing slips or delivery receipts and compare the information to the corresponding PO to ensure that the goods or services were received as expected.

- Invoice Creation: Nanonets can help automate the invoice creation process by extracting data from purchase orders or other source documents. Using machine learning algorithms, Nanonets can extract relevant information such as vendor names, item descriptions, and pricing information and input that data into an invoice template.

- Invoice Approval: Nanonets can help streamline the invoice approval process by using natural language processing (NLP) to extract data from invoice documents and route them to the appropriate approver. For example, Nanonets can analyze the content of an invoice and automatically send it to the department manager responsible for approving invoices for that particular vendor.

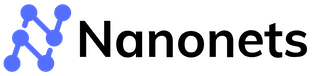

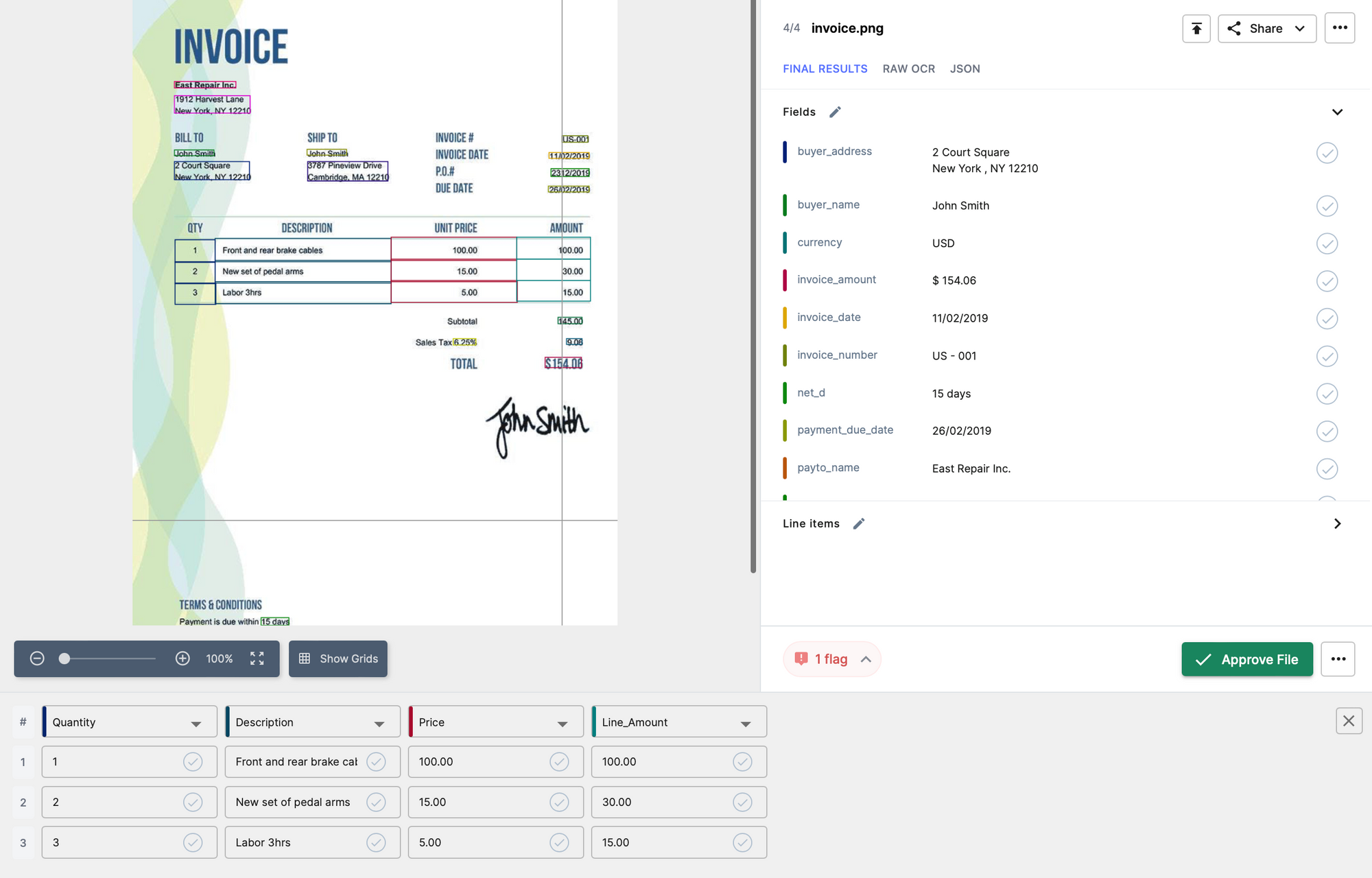

- Invoice Processing: Nanonets can help automate the invoice processing by extracting data from invoices and inputting that data into the accounting system. For example, Nanonets can extract relevant information such as invoice numbers, vendor names, item descriptions, and pricing information and input that data into the appropriate fields in the accounting system.

- Payment Authorization: Nanonets can help streamline the payment authorization process by automatically routing payments to the appropriate approver based on predefined rules. For example, Nanonets can analyze the payment amount and route it to the budget manager responsible for approving payments within that particular department.

- Payment Processing: Flow by Nanonets can help automate the payment processing by extracting data from invoices and generating payments. For example, Nanonets can extract relevant information such as payment amounts, vendor names, and payment terms, and generate a check or initiate an electronic payment.

- Payment Reconciliation: Nanonets can help automate the payment reconciliation process by matching payments to the original invoices and identifying any discrepancies or errors. For example, Nanonets can analyze payment data and identify invoices that have not been paid or that have been overpaid.

- Vendor Account Reconciliation: Nanonets can help automate vendor account reconciliation by analyzing payment data and identifying any outstanding balances or discrepancies. For example, Nanonets can analyze payment data and identify vendors with outstanding balances or invoices that have not been paid.

In summary, using Nanonets OCR in the accounts payable workflow can help automate several steps in the process, bringing benefits such as faster processing, reduced errors, lower costs, improved data accuracy, enhanced productivity, improved vendor relationships, better cash flow management, and improved compliance. By leveraging OCR technology, organizations can streamline their accounts payable processes with best practices to save time and money, and improve overall efficiency and effectiveness.

Looking to automate Accounts Payable using OCR? Look no further! Try Nanonets Automated Accounts Payable OCR Workflows for free.