What is Invoice Processing? Definition and Key Steps in 2024

When businesses receive goods or services from vendors and suppliers, those vendors and suppliers expect to be paid on time and in accordance with the contractual agreement the business has with them.

The time between receiving an invoice from a vendor and paying the invoice is defined as invoice processing. Vital for building business relationships and maintaining an inflow of critical supplies and services, invoice payment processing is one of the key responsibilities of the accounts payable function.

What is Invoice Processing?

Invoice processing is a fundamental business function executed by the accounts payable department. It encompasses the tracking, management, and payment of supplier invoices, serving as a pivotal step in the procure-to-pay (P2P) process and concluding the procurement cycle.

When your utility company sends the invoice for your monthly electric bill, it’ll go through the invoice processing system to get paid on time and keep the lights on in your office. When your parts supplier sends a new shipment of components needed to manufacture your product, they’ll follow up with an invoice that you can process and pay. Both the Source-to-Pay and Procure-to-Pay processes end with invoice payment processing.

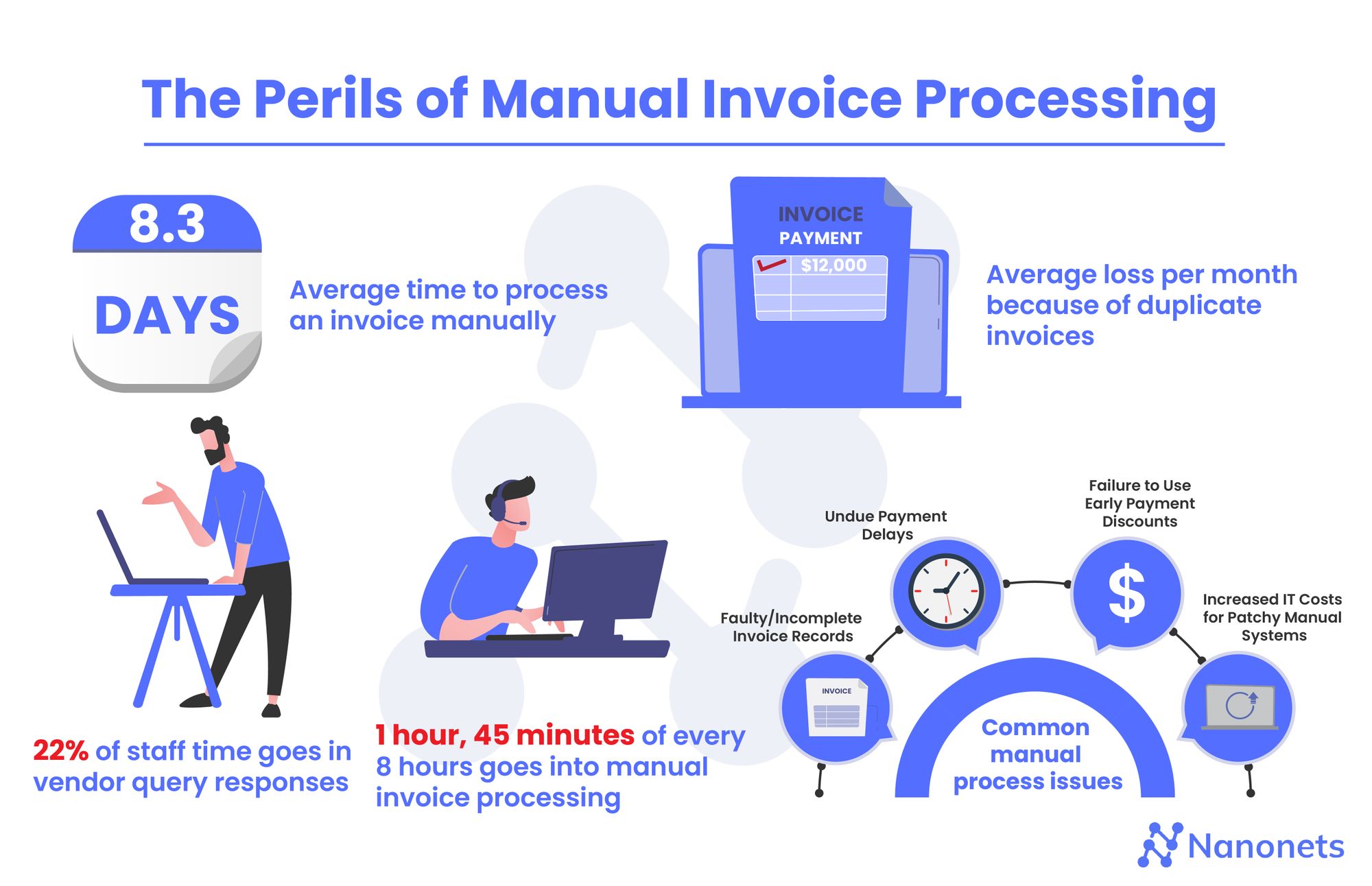

For a long time, invoice payment processing was done manually, without the help of automation and other advanced technologies. Every step of invoice processing required an AP expert to receive the invoice, verify its accuracy, track the invoice through the approval flow, send a payment to the vendor, and finally, record the transaction in the proper accounts.

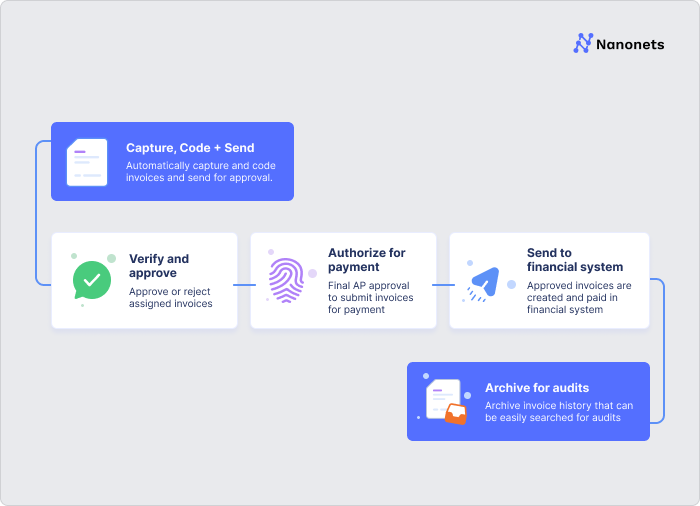

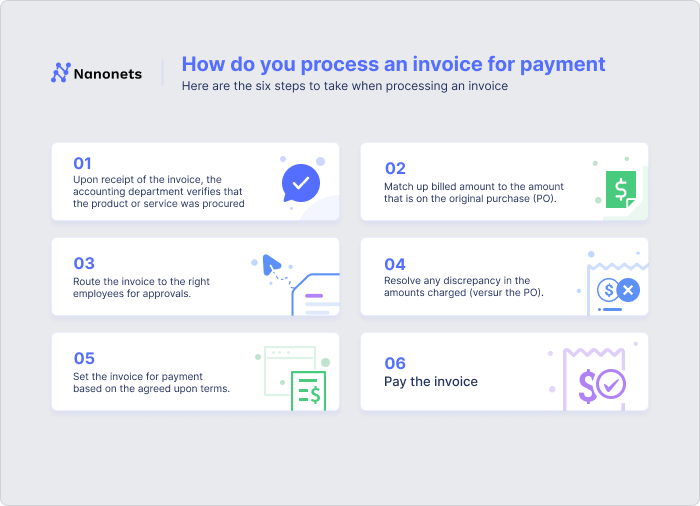

5 Steps of the Invoice Processing Workflow

Accounts payable invoice processing is the backbone of every business, but often, it sits in the background, unnoticed, until something goes wrong. If the invoice payment process is delayed, vendors could hold future shipments, charge late fees, or cut ties with you as a customer entirely.

Each step of the invoice payment process plays an important role in preventing the breakdown of these back-end business functions.

An invoice is received from a vendor.

Once you send the purchase order, the vendor ships the items on the purchase order, you can expect to receive an invoice shortly after. If you really want your AP team to go paperless, try and set every vendor up with e-invoices so they aren’t mailing or faxing hard copies that you then have to scan into the system. E-invoicing is common practice in most business supplier relationships today.

Every invoice should contain the invoice date, product information, quantity of items sold, the total payment amount owed, and contact information for both entities. With this information clearly presented, the next step in the invoicing process can be completed with ease.

The invoice is checked, verified, and entered into your invoice processing system.

At this point, your AP team will need to conduct three-way matching for each invoice, ensure the goods were received, and verify that all the information in the system is correct. This step is crucial, but with the proper AP internal controls in place, you can rest easy knowing that invoices are being verified prior to payment.

The invoice is sent through the approval workflow and approved.

Invoices cannot be paid without the proper approvals in place. Approvals are a critical part of the audit trail for both internal and external audits. Depending on the amount on the invoice, the approval workflow may vary slightly. Without an invoice processing system, the invoice can get lost in an inbox or buried on a desk, awaiting approval until after its due date.

AP processes the payment.

When the invoice has been reviewed, verified, and approved, payment can be sent. Gone are the days of checks in the mail; now, AP relies on ACH, wire transfers, EDI payments, and other similar methods to get payments to vendors and suppliers. Depending on your agreement with each supplier, the payment method used could vary, so be sure to clearly track how each vendor should be paid.

The invoice is closed, and its payment is recorded.

At this point, everything is done, right? Wrong. The received invoice and its associated payment need to be recorded in the proper accounts within the general ledger. The AP team will need to submit journal entries, true-up the general ledger, and verify that each account has the proper amount at the end of the monthly close.

Benefits of an Automated Invoice Processing System

56% of AP teams spend 10 hours or more each week processing invoices. Today, many businesses have begun exploring the power of automating tasks related to the invoice process. An automated invoice processing system can streamline the invoice payment process, improve accounting data accuracy, enhance vendor relationships, and so much more. After assessing each step of the invoice processing workflow, it starts to become clear just how much of an impact automated AP software can have on this aspect of your business. AP teams that fail to employ automated invoice processing tools spend 4x more processing invoices than their automation-savvy counterparts.

Although the possibilities surrounding accounts payable invoice processing are endless, many businesses haven’t achieved an optimal state just yet. In fact, according to a survey by the Institute of Financial Operations & Leadership, 22% of business leaders said delays caused by time spent processing invoice exceptions were their top AP challenge. Automating AP invoice processing can remove these roadblocks, allowing businesses on both sides of the transaction to thrive. The top benefits of automating the invoice payment process are:

Heightened Data Accuracy

With manual invoice payment processing, data errors are inevitable. Humans make mistakes; they may switch two numbers, record information in the wrong account, or even make incorrect payments when processing invoices for payment. If instead, these same people rely on automation to enter data, record transactions, and prepare payment details, errors are much less likely. Computers, unlike humans, don’t usually make data entry errors.

An invoice processing system can do the same level of data verification – if not better – in a fraction of the time that humans can process things manually. It can communicate with your warehousing system to verify the goods have been received, scan through the accounting information to ensure everything was recorded correctly, and even initiate further automation capabilities.

Improved AP Productivity

There are only so many hours in the day. Juggling competing priorities, managing scaling business requirements, and dealing with inevitable issues that come up can leave little time for much else, including AP invoice processing. AP automation allows your team to focus on a smaller set of priorities, improving productivity and increasing job satisfaction.

For instance, instead of submitting manual journal entries or recording the information by hand, AP can rely on the invoice processing system to communicate with your accounting ERP to record the payment. AP automation also enables automated vendor payments, approval workflows, and three-way matching to verify every single invoice.

Reduced Payment Timelines

Processing invoices for payment on time or ahead of schedule can actually save businesses money. Some vendors offer reduced rates for early payments while others will be willing to provide more favorable payment terms to businesses that they can depend on to complete the invoicing process quickly.

Enhanced Vendor Relationships

Suppliers want to work with clients they can trust. Every business relationship is centered on human interaction; if your vendor can’t trust you to submit correct payments on time, they could end the partnership you have. After that, word travels fast, and you might have a tough time getting alternative vendors to sign a contract with you. These are not relationships any business can afford to mess up, and with automation, the odds of harming these dynamics go down.

Real-Time Insights & Analytics

Understanding the cash flows in and out of your business, knowing when product deliveries are late, or being able to anticipate an increased need for more raw materials all rely on detailed analytics. With old, manual invoice payment processing, real-time analytics are hard to capture, but with automation, business leaders could have an entire dashboard of up-to-date insights at their fingertips.

Nanonets: The Key to Automated Invoice Processing

Automating the invoicing process is one of the first steps on the AP automation journey. It sets the foundation for improved data analysis, optimizes the supplier payment process, and allows your team to focus their efforts elsewhere while still providing peace of mind that your vendors are getting paid. If you’re looking for a place to start your AP automation journey, this is it.

With Nanonets, invoice payment processing is easier than ever. Our invoice processing system uses smart financial controls to prevent overpayments, automatically reconciles accounts impacted by these transactions, and houses the invoice approval workflow from start to finish. We’ve been equipping businesses with the capabilities needed to achieve optimized and automated invoice processing for years; we can help your business do the same.

.png)

.png)

.png)

.png)