Best Accounts Payable Software

The Accounts Payable Process

Xero Accounts Payable Automation

AP automation that automatically reads emailed or scanned invoices and captures relevant information. Receive real-time notifications for invoices that need your attention.

Our AP automation software captures and verifies every invoice detail - including line items and GL codes - and syncs to your accounting tools instantly.

Set up custom accounts payable approval policies with any combination of approvers, spend limits and department structures. Don’t want the hassle of creating invoice approval policies? Let our AI handle it.

.webp)

Truly touchless invoice processing powered by AI and machine learning. Read, capture, match, and approve invoices with minimal manual intervention.

Set up advanced invoice or PO matching rules with automated 2 way or 3 way matching. Flag duplicate invoices, variations in PO/receipt details, and prevent vendor fraud.

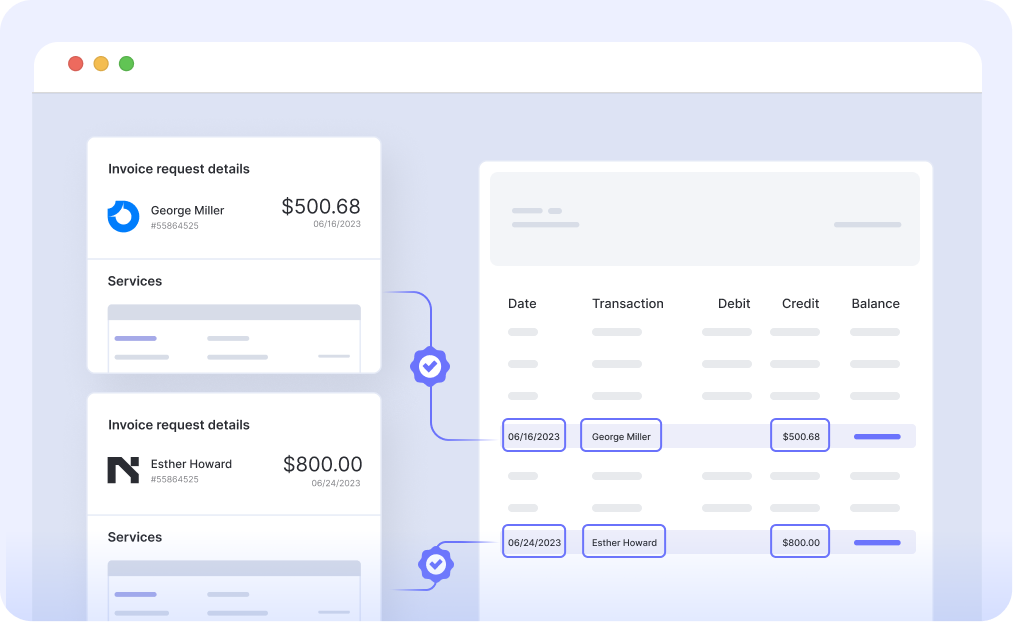

Reconcile and match internal records of transaction or payments with bank statements, credit card statements etc. for a faster financial close.

Book a free 30 minute consultation with our experts!

Discover important details about automated accounts payable and the Nanonets accounts payable automation software.

AP automation or accounts payable automation is the use of technology systems to automate common vendor invoice processing tasks and accounts payable processes. AP automation software uses a combination of AI, machine learning and intelligent OCR to automate manually intensive AP tasks such as receiving, capturing, coding and entering invoices. AP automation also allows finance teams to set up intelligent workflows to automate PO matching, duplicate data or mismatch alerts, approval routing, payments and reconciliations. AP automation aims to improve the efficiency, accuracy, and speed of the entire accounts payable process. It also reduces manual workload, the likelihood of vendor fraud and overall costs for businesses. Automating key accounts payable functions allows finance or AP teams to access all AP data and analytics in a digital setup, scale their operations without increasing the headcount, gain in-depth visibility into overall spends and achieve a faster financial close.

Accounts payable (AP) automation essentially presents an automated workflow that removes manual effort and errors during invoice capture, data entry and validation, approvals, payment, ERP integration, and reporting. AP automation software use a combination of OCR, AI and machine learning to read and digitize important information from incoming vendor invoices. The AP automation workflow can then verify and validate the data by matching it against supporting documents like the PO or receipt. It then intelligently routes it to the appropriate approver. Once successfully approved the invoice is integrated into the ERP or accounting system to be processed for payment. The entire process is tracked and reported in real-time, providing visibility into the accounts payable process and aiding with compliance, auditing, budgeting, and forecasting.

Accounts payable automation offers various advantages that can significantly benefit businesses. This includes improving accuracy, automatic invoice matching, integrating with accounting software, streamlining invoice approval and providing audit trails. One of the most significant advantages is the reduction of invoice processing costs by minimizing the need for manual effort. As businesses grow, this automation can also aid in scaling AP processes without requiring additional hires. AP automation also reduces the risk of fraud and errors, leading to smoother audits and accurate financial records. Another valuable tool offered by AP automation is the ability to manage payments and cash flow efficiently. By streamlining the payment process, businesses can increase their ability to capture supplier payment discounts and improve cash flow. Automated accounts payable can also help ensure compliance with regulatory and legal requirements and reduce the risk of fraud.

According to the American Productivity & Quality Center (APQC), the cost to process an invoice varies between $1.42 per invoice for top performers (companies in the 25th percentile) to $6.00 per invoice for bottom performers (companies in the 75th percentile). Just a few years ago, in 2018, this range was $2.00 to $9.00 per invoice. This improvement, most likely, points to the rising adoption of automation and smart technologies in accounts payable business processes. AP automation can bring cost savings to businesses by reducing labor costs and late fees. While the costs associated with traditional paper-based payments such as check stock, envelopes, and postage are easily identifiable, there are also costs associated with the time spent on manual tasks related to processing payments. According to a 2018 report by Goldman Sachs, B2B businesses in North America spend $187 billion annually on AP processing - and this estimate captures only direct processing and labor costs; in fact, labor accounts for over 90% of direct costs incurred.The costs of automated AP processing, according to the same report, are only 33% of manual costs!

AP automation software, like Nanonets, streamlines the accounts payable invoice approval process by identifying the correct approvers, sending notifications, and automating reminders. Invoices are captured and routed through an automated workflow for approval by the appropriate parties. This process can be configured to include different levels of approval, depending on the value of the invoice or the department it is associated with. AP automation can also identify and intelligently handle exceptions and route them to the appropriate individuals for further action. The automated workflow makes it easy to track and monitor the approval process, ensuring that invoices are processed in a timely manner and are not kept pending.

Most AP automation software provide AI-powered financial control features to prevent vendor or payment fraud. These include vendor level controls, AP access control for different employees, invoice matching (2-way, 3-way etc.) and advanced data mining to detect patterns & deviations indicative of fraud. Nanonets can flag duplicate invoices or invoices entries that have been modified, prevent users from approving payments beyond preset limits or automatically add additional approvers, and also highlight unusual variations in vendor payments or AP activities.

Accounts payable software systems can work with accounting systems through integration options, such as API or middleware, to provide seamless data transfer. This way, AP automation software can retrieve data such as invoices and purchase orders from accounting/ERP systems, process them and update the record/information in the ERP or accounting platform. With such native integrations, businesses can take advantage of the AP automation software's features and automation capabilities, while still using the accounting/business software of their choice. Nanonets, for example, can be integrated with other accounting systems, such as QuickBooks, Microsoft Dynamics, Sage and more.