- Home

- Invoice Processing

- Finding the Best Invoice Processing Software in 2024

Finding the Best Invoice Processing Software in 2024

Invoice automation software streamlines accounts payable processes by eliminating manual data entry, reducing processing delays, improving visibility, mitigating compliance risks, and cutting processing costs.

Your accounts payable team – whose main function is to ensure funds are disbursed properly to vendors, business partners, and sometimes customers – processes an exorbitant number of invoices every single week. When done manually, processing an invoice can take days. If an AP expert has to conduct three-way matching checks, route the invoice to the proper department for approval, initiate the payment process, and get another approval before sending funds, there are many potential stopping points in the process.

With AP automation software, and more specifically, invoice processing software, the time it takes to process an invoice and send a payment gets drastically reduced. These solutions can conduct matching processes, route the invoice for approval, prepare necessary payment information, and more, giving a major chunk of time back to the entire AP team each week.

There are many invoice processing software options available today, but we’ve sifted through all the brands, identified the strongest on the market in 2024, and prepared a comprehensive guide, all in an effort to make your selection of invoice automation software a breeze.

Learn about the critical role of account reconciliation in invoice automation by exploring our detailed article at What is Account Reconciliation?.

Top 10 Invoice Processing Solutions in 2024

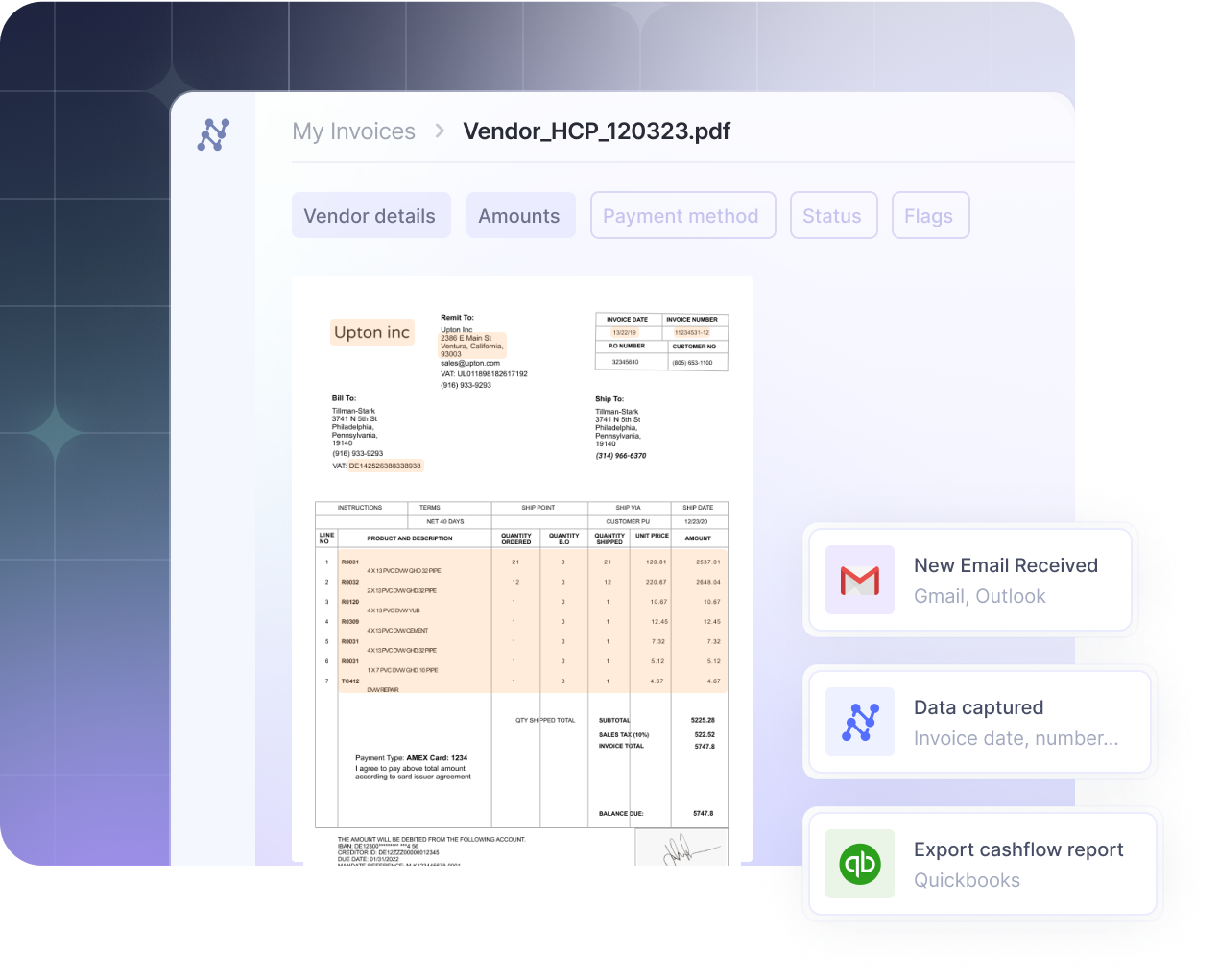

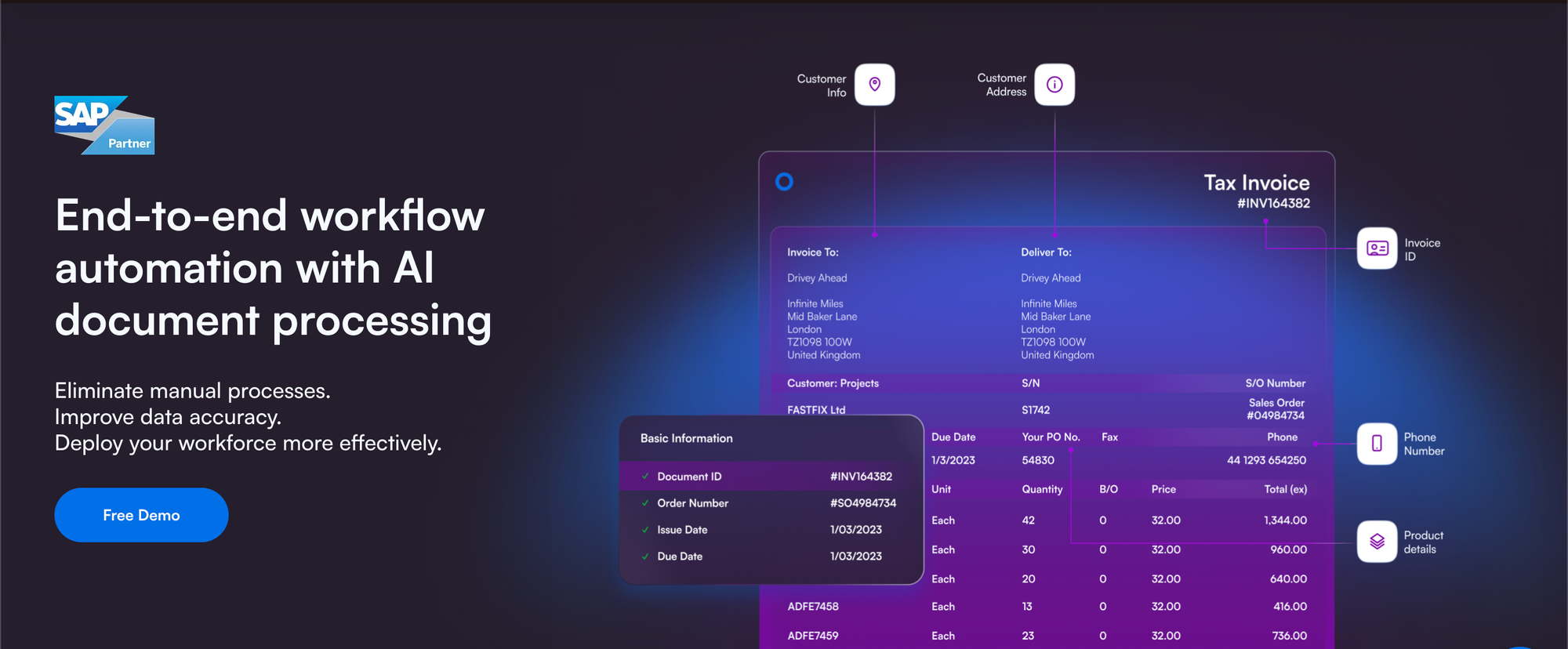

1. Nanonets Flow

Nanonets Flow automatically extracts key data fields from every invoice your business receives. Invoices don’t have to be received in a uniform format; instead, its invoice AI model is trained to pick up on all the key fields needed to process an invoice. Since the platform offers end-to-end automated AP management, it allows your AP team to import, approve, and pay invoices all in one place. With insightful dashboards and advanced reporting mechanisms, Nanonets Flow takes accounts payable automation up a notch.

Key Features

Compatible with currencies from more than 45 countries around the world, Flow supports international transactions for your growing business. Using AI, every transaction is kept secure through duplication detection, fraud prevention, and payment tracking features. Since 1-click approvals from your mobile phone, email account, or Slack profile are enabled, doing business from anywhere has never been easier.

Pros

Nanonets integrates with QuickBooks, Xero, Sage, NetSuite, and other top ERPs and business systems. With an unbeatable pricing model that doesn’t get pricier as you grow, Nanonets benefits are accessible to businesses at all stages.

Cons

For more complex business needs, users note that the Nanonets model takes some effort to train. However, once things are set up, investing in customizations and model training pays off.

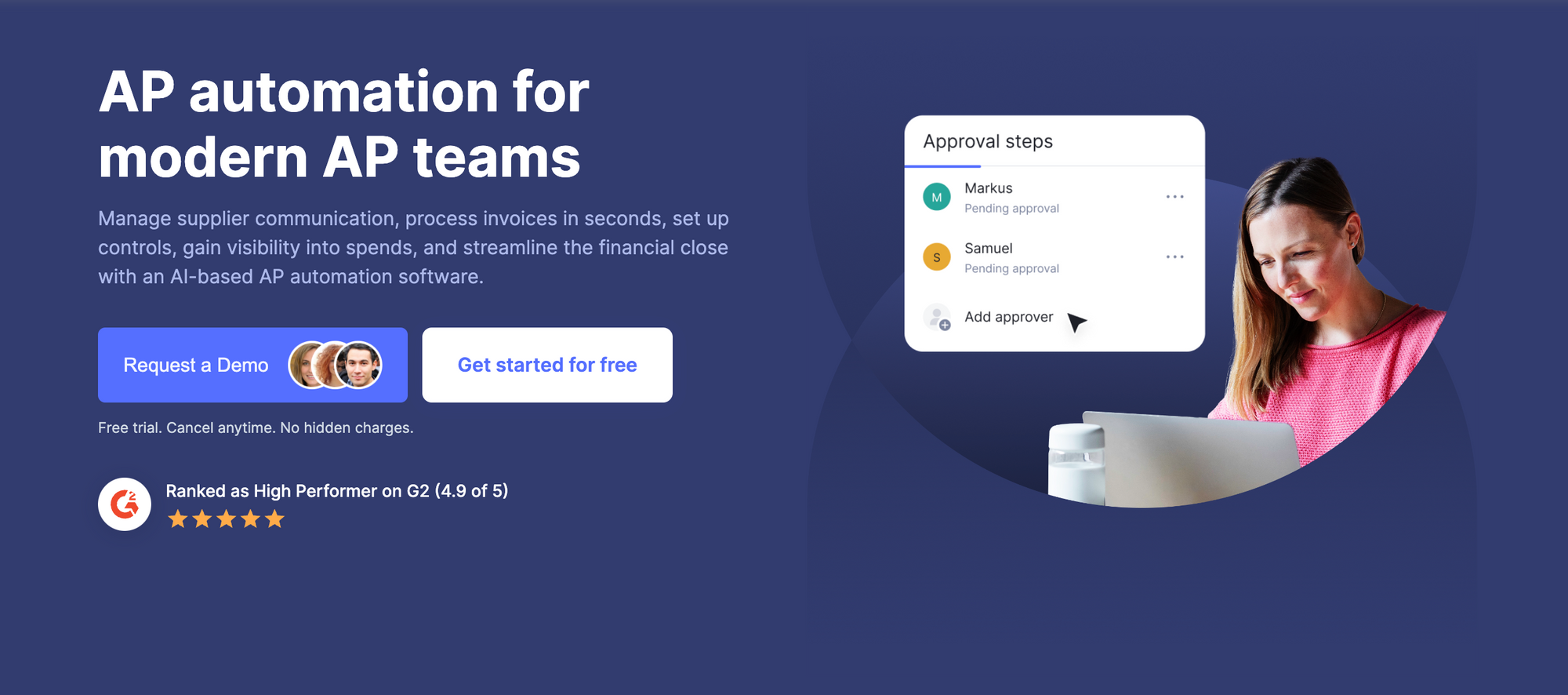

2. Airbase

If spend management is your primary goal, Airbase is one of the top invoice processing solutions. It brings together AP functionality and expense management, saving your teams time and saving your company money. It supports complex business requirements like multi-subsidiaries and multi-currency purchase orders. Most used in technical spaces, Airbase offers your business a chance to refresh its invoicing approach with this automated invoice system.

Key Features

Not all invoice processing solutions accommodate unique purchase orders or multi-layered supplier agreements. Automated approval workflows, helpful support staff, and a continuous improvement approach make Airbase one of the top invoice automation tools.

Pros

Users love that it’s easy to learn and quick to implement. Regular updates ensure that the tool serves customers as business needs change.

Cons

Airbase lacks reporting capabilities according to some users. This makes it difficult for them to reconcile their general ledger, chase down any errors, and can ultimately slow down the accounting cycle overall.

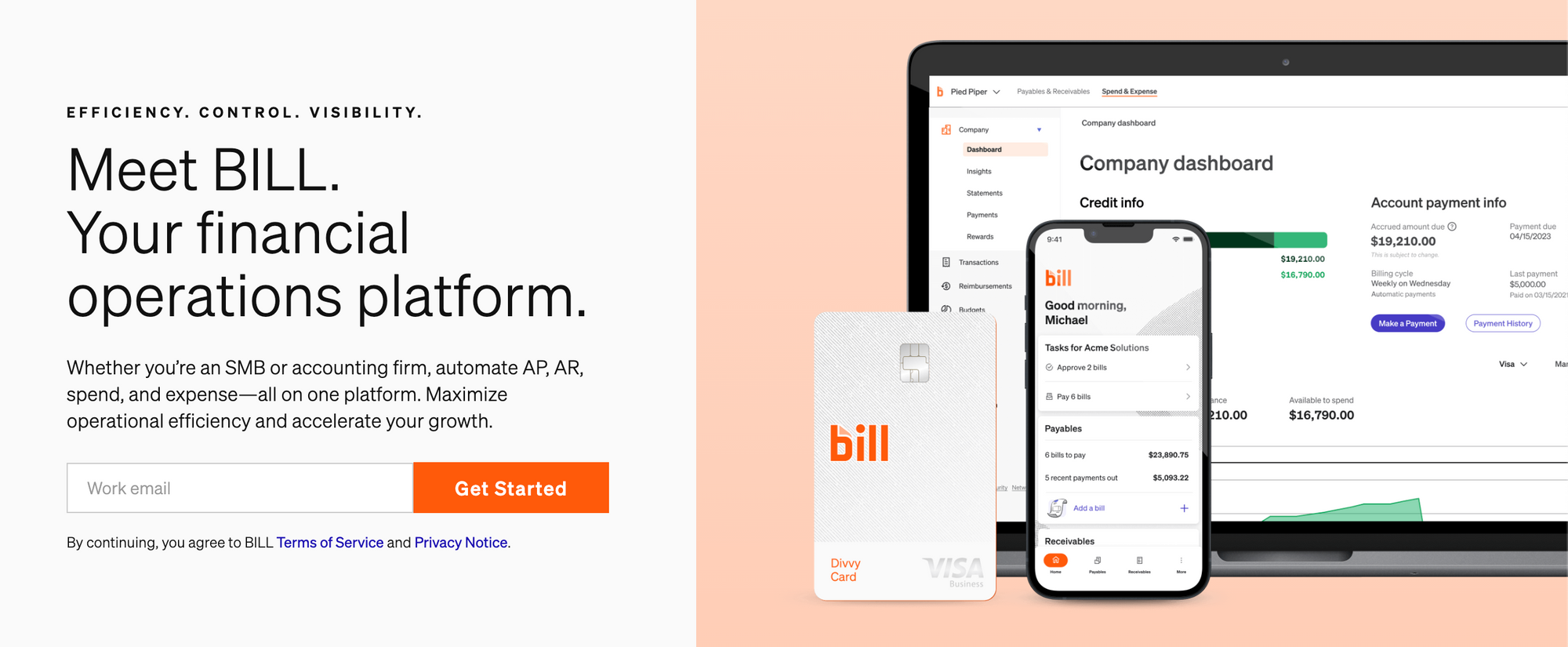

3. Bill

When invoice automation software is primarily used in the accounting industry, it’s almost guaranteed to be good. Bill is an invoice automation solution that offers a wide range of financial capabilities, making it a good foundational tool for businesses. With all AP process needs in one place, Bill can transform the daily grind associated with AP roles.

Key Features

Connection capabilities with various finance and accounting tools, clear audit trails, approval workflow customizations, and simple vendor onboarding are just a few of the key features that landed Bill on the list of best automated invoice processing software.

Pros

With Bill, payments can be completed with the click of a button, and every transaction is validated immediately with the “sync errors” feature.

Cons

Not great for international transactions, Bill does not support payments in multiple currencies or payments outside the US at all. This can be very limiting for businesses looking to expand in the future.

3. Rossum

More than invoice automation software, Rossum harnesses the power of AI, machine learning, and computer vision to show its users the future possibilities of the AP function. Boasting an average accuracy rate of 96%, Rossum’s models eliminate a ton of manual work, allow for customizations, and can be used by employees with barely any coding experience.

Key Features

This robotic process automation (RPA) enabler is cloud-based, easy to configure, and uses APIs to connect with other digital tools. With special user training materials, webinars, and detailed documentation, Rossum is an invoicing processing software that makes change management easier than ever.

Pros

The cutting-edge features brought to the table by Rossum set the standard for other invoice processing solutions. Always one step ahead, Rossum helps its users stay ahead of the curve, too.

Cons

Because of the many technologies woven into the tool, Rossum can be a bit slow when processing data, and sometimes experiences short system outages.

4. SAP Concur

SAP Concur demo video

Widely recognized as a travel expense management tool, SAP Concur has a broader application, reaching into the invoice processing solutions space seamlessly. This invoice automation solution has a favorable mobile app for employees and employers to use when processing expenses. The application breaks down expense types, allows individual-level tracking, and automates the payout process.

Key Features

SAP Concur has a lot of force behind it; SAP is one of the most well-known finance and accounting solution builders in the business world today. It can accommodate large businesses, allowing thousands of users to benefit from built-in currency conversion capabilities, automated expense reports, and digital receipt management.

Pros

No other invoice automation solution solves for travel management like SAP Concur. This automated invoice processing software is one of the best invoice automation tools if your employees travel often.

Cons

Because it serves larger organizations, SAP Concur can be tricky to customize, the interface isn’t as intuitive as other tools, and it’s slow to adopt new functionality.

5. Stampli

If you want the benefits of AP automation but don’t want to overhaul your entire technology stack, Stampli thrives in the middle ground. All AP communication, documentation, and approval flows can be transitioned to Stampli while upstream and downstream processes like procurement management and manufacturing automation can remain in functional ERPs.

Key Features

Embedded fraud detection capabilities, advanced vendor management, and compliance features are a few user favorites.

Pros

Stampli’s customer service team is easy to reach and responds to tickets quickly.

Cons

Stampli isn’t very good for netting, so users who use netting agreements with their vendors may run into some headaches. Additionally, the vendor payment process is time-consuming and overly complex.

6. Tipalti

For a fully integrated invoice automation software and accounts payable software, Tipalti is a crowd favorite. Supporting fast-growing companies means that Tipalti is agile, adaptive, and up for a challenge. It makes supplier onboarding easy, reduces the cost of processing every invoice, and has built-in tax compliance capabilities on a global scale.

Key Features

With automated three-way matching, instant account reconciliation, and global payment support, Tipalti is a front-runner amongst other invoice processing solutions.

Pros

End-to-end AP automation will truly transform your entire accounting and finance function.

Cons

Tipalti isn’t an invoice processing software that’s known for easy integrations. Its intricate setup process and lagging customer support can throw a wrench in the overall digital transformation approach for your organization.

7. Kofax

When it comes to invoice processing solutions, the main differentiator in successful vs. non-successful solutions is the document processing power. Kofax processes data from documents quickly using OCR, scanner recognition, and VRS functionality. Its no-code approach ensures that you won’t need tech-savvy AP teams to get benefits from this automated invoice processing software.

Key Features

Integrated analytical capabilities highlight spend areas, automate AP aging reporting, and help you make better business decisions.

Pros

The no-code approach makes Kofax one of the most accessible invoice processing systems on the market.

Cons

The solution is more costly and less customizable than similar invoice processing systems on the market.

8.ABBYY Flexicapture

To truly go paperless, you need invoice processing solutions like ABBYY Flexicapture. It can take data from documents in any format, extract what your systems need to process the invoice, and propel payment completion. It’s a solution centered around scaling with your business, so if you’re ready to take things up a notch, ABBYY Flexicapture is ready to help.

Key Features

Accurate data capturing, verification capabilities, and document imaging help ABBYY Flexicapture support your AP function.

Pros

It can handle unstructured data and allows your business to input specific rules or requirements into the tool.

Cons

This tech-heavy invoice automation solution has a major barrier to entry for non-tech-savvy teams. Additionally, the platform’s updates are notorious for taking a long time and forcing users to reinstall the solution.

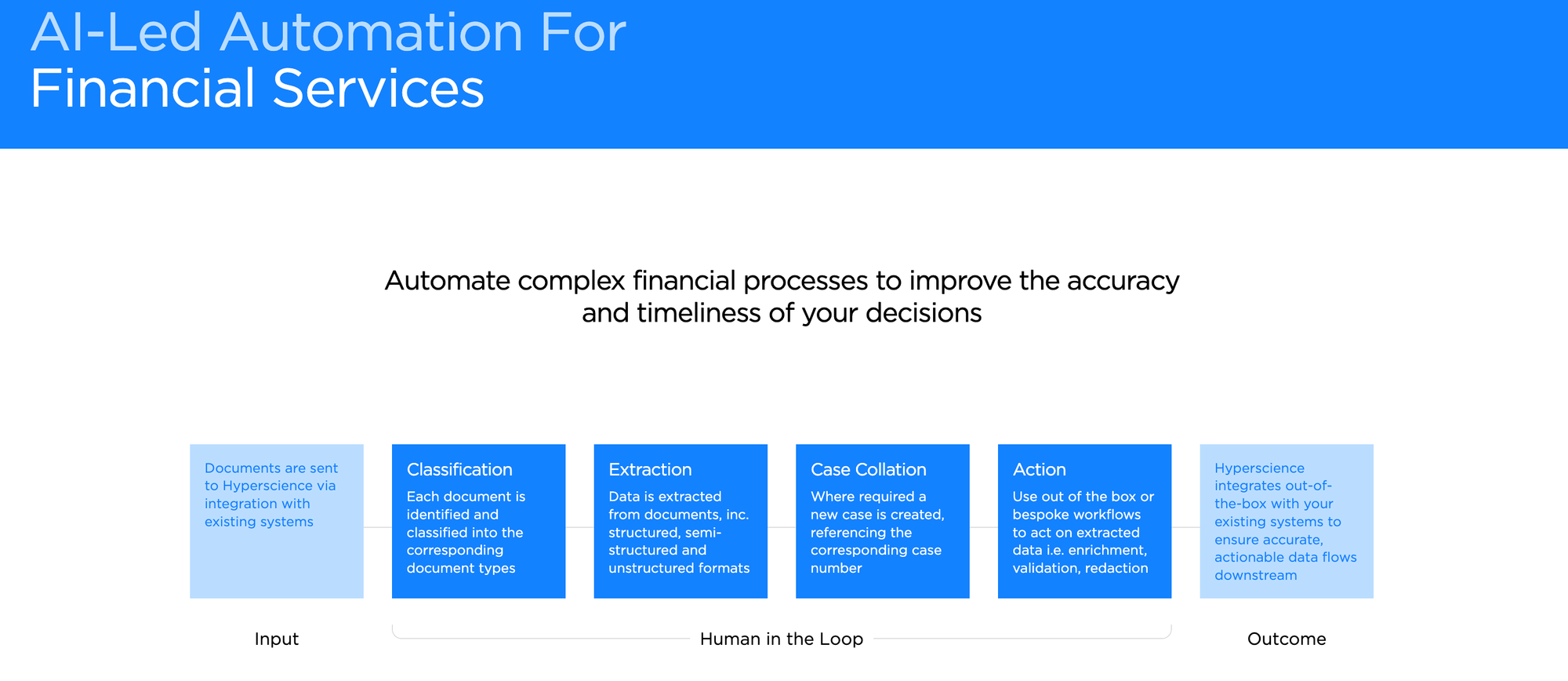

9. Hyperscience

Some of the most stringent data security standards of all invoice processing solutions exist within Hyperscience. Even further, this invoice automation software with on-premise tools, cloud-based technology stacks, REST APIs, and even SDKs. Right when you install this automated invoice system, it can automate 80% of an accounts payable team’s workload.

Key Features

Since it works really well with legacy ERPs, Hyperscience is a solution that can meet your company where it’s at. Despite being compatible with older software solutions, it enables custom reports and automated data analytics.

Pros

Its data extraction capabilities extend to handwritten information too. If you work with vendors that send invoices with writing on them, this solution can process those invoices just as well.

Cons

To successfully read PDFs, Hyperscience must have user help in configuring the PDF setup. If your vendors send PDFs in different formats, each vendor invoice will require your AP team to show Hyperscience where certain data points are on the invoice.

10. Melio

Melio demo video

Melio is a PCI-compliant invoice automation software that keeps sensitive data secure throughout the entire source-to-pay process. Like its peers, Melio matches invoice data to purchase orders and transactions, supports multiple payment methods, and features an online payment portal when used for accounts receivable functions.

Key Features

Melio supports check payments as well as ACH, wire transfers, and other fund disbursement methods. You can set up monthly payments ahead of time and coordinate direct deposit with your vendors.

Pros

Melio can be used for free to send payments to vendors. Its low-price model can help you enhance your AP function without breaking the bank.

Cons

Because of the low pricing structure, Melio has very limited support options, doesn’t allow many customizations, and has invested less in the user experience than other invoice processing systems.

Other Notable Software Options

If you feel like the best automated invoice processing software for your needs is still waiting out there somewhere, check out one of the following solutions:

- Docsumo

- Xero

- Sage Intacct

- Hypatos

- Amazon Textract

- Coupa

- Honeybook

- TallyPrime

The market for invoice automation software is growing quickly, so don’t get discouraged if you feel like you haven’t found the right solution just yet. It’s out there!

Invoice Processing at Its Finest

The accounts payable function is one of the best candidates for automation because of the nature of the work in the function. Many of the tasks are manual, time-consuming, repetitive, and data-processing heavy. There are many best practices to boost efficiency in the AP function, but often, these tasks can be streamlined or completely taken on by AP software solutions such as invoice automation tools.

We like to remind finance and accounting leaders, as well as AP experts themselves, that AP automation is not meant to replace the people who have been doing these tasks for years. Instead, it’s meant to get rid of some of the most stressful aspects of their jobs and allow them to move into more strategic roles within the function. There’s a major need for accounting and finance digital transformation, but its benefits won’t be fully recognized until we understand that humans and technology are supposed to work together moving forward. Technology is not the enemy.

Start with invoice processing systems and work up from there. Many of the automated invoice processing software options above can go even further, having a major impact on your organization’s ability to serve its customers.

.png)

.png)

.png)

.png)