Why Is Bank Reconciliation important in accounting?

How to reconcile bank statements more efficiently?

Credit Card Reconciliation: What It is and How to Do It?

Leader 2023 (4.8)

Our AI-powered system rapidly reconciles accounts, identifies discrepancies, and generates detailed reports, reducing manual effort and ensuring accuracy. Close your books faster than ever with Nanonets.

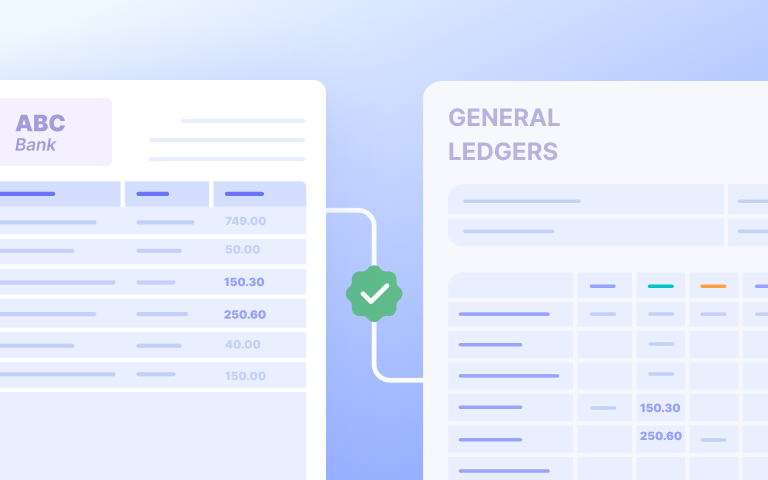

Our platform integrates with your banks and general ledger, automatically matching transactions across systems. Nanonets' advanced algorithms quickly pinpoint exceptions, saving your team valuable time and effort.

Nanonets' AI technology intelligently categorizes transactions, detects anomalies, and syncs data, empowering you to reconcile accounts with ease and precision directly in QuickBooks.

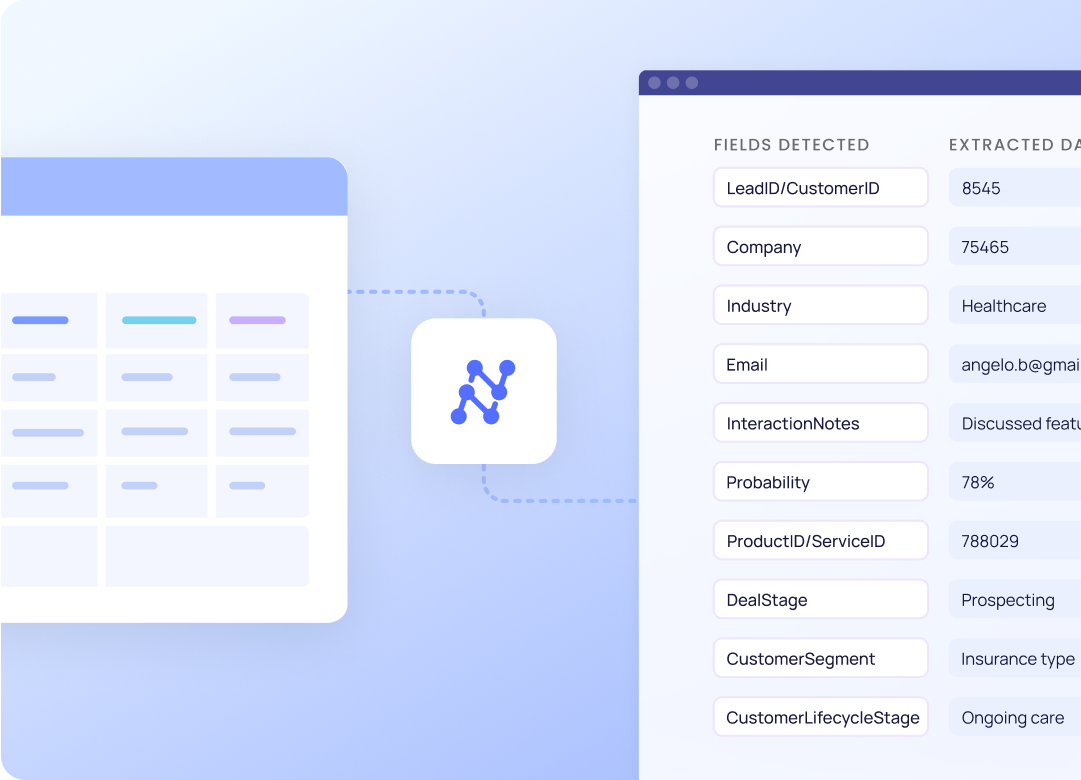

Use natural language input to extract structured data from your documents

Nanonets' accounting reconciliation software initiates the process with automated data extraction. It imports data from different sources, reducing the need for manual data input and potential human errors.

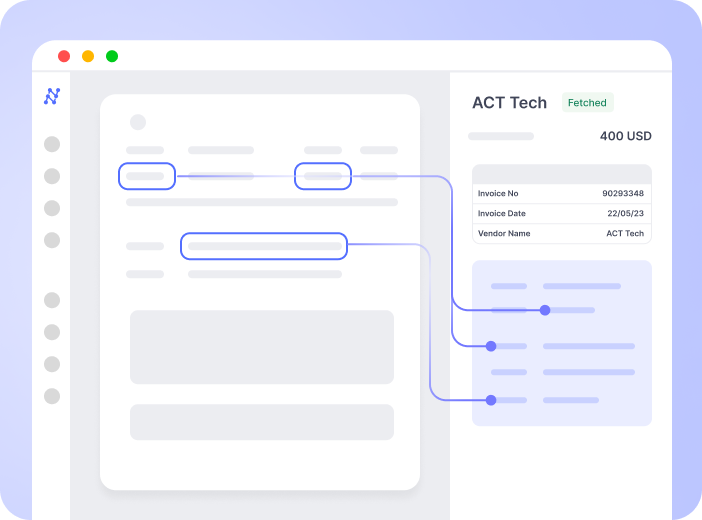

Automate data extraction from bank statements, credit card statements, and invoices to save 90% of your time. Read, capture, and format the relevant information as needed.

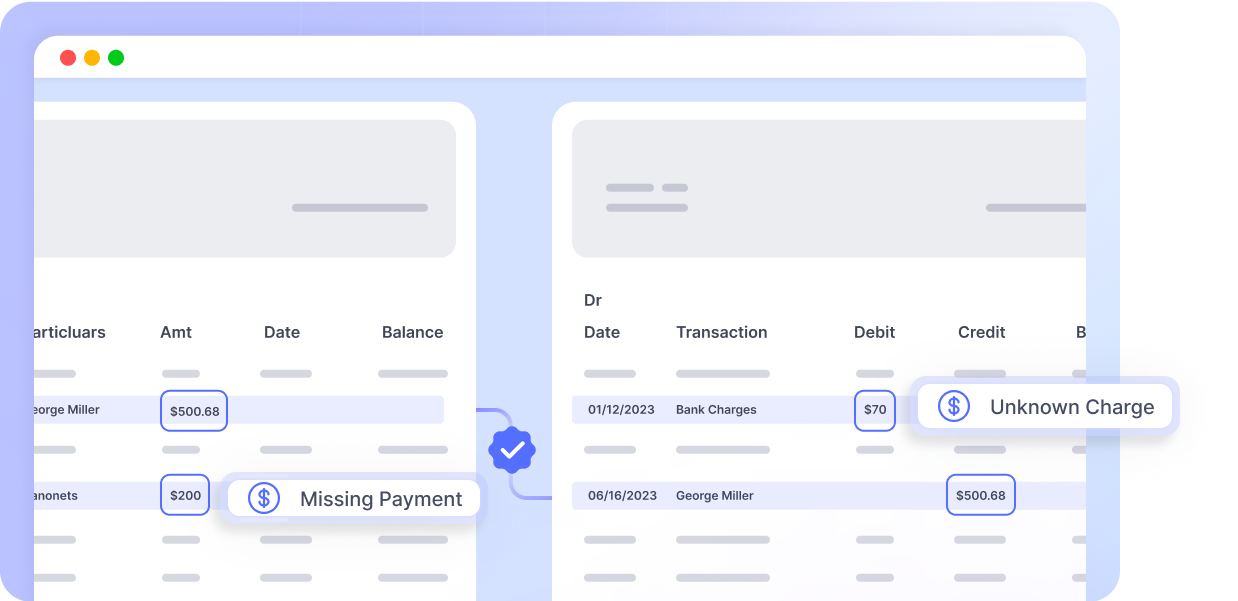

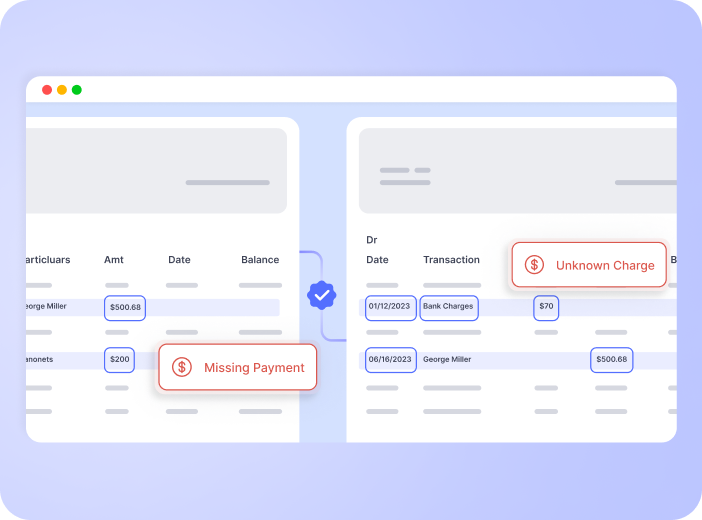

Businesses lose up to 5% of revenue to fraud and theft. Save cost by real-time fraud detection to flag duplicates, missing payments, outliers, or unauthorized transactions.

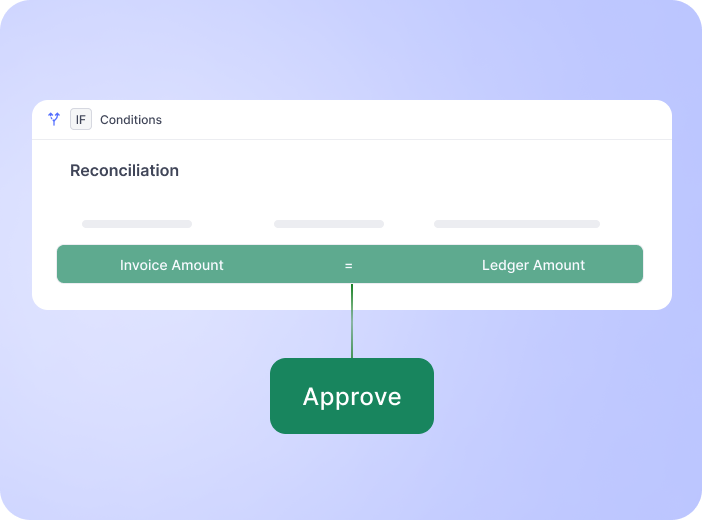

Leave behind Excel, macros, and multiple accounting tools. Set up no-code blocks to match and approve your transactions based on your business logic.

We seamlessly integrate with your existing business process, instantly supercharging it. Seamless integration with 100s of tools, including Gmail, Quickbooks, Xero, & Stripe.

With Nanonets' automated reconciliation software, businesses can process up to 90% more transactions in the same amount of time compared to manual reconciliation methods. This remarkable efficiency boost allows teams to reallocate their resources and focus on higher-value tasks, driving productivity and growth.

Manual reconciliation processes are prone to human errors, which can lead to costly discrepancies and compliance issues. Nanonets' automated reconciliation solutions boast an accuracy rate of 99.9%, virtually eliminating errors and ensuring the integrity of your financial data.

Nanonets' automated reconciliation software can scale seamlessly, handling up to 5 million transactions per day at a fraction of the cost of manual reconciliation. On average, businesses save up to 75% on reconciliation costs by automating with Nanonets.

Discover important details about our product.

Nanonets can extract data from all kinds of documents, including invoices, receipts, POs, bank statements, credit cards, checks and more.

Nanonets provides out-of-the-box integrations with all major ERP and payment applications. It brings together all your financial statements to one UI, allowing you to reconcile and validate in-app.

Nanonets AI can suggest matches to help quickly reconcile. To detect errors and fraud, you can establish logic-based flags for identifying duplicates, missing payments, and unauthorized transactions.

Nanonets utilizes a workflow-based model that is capable of operating across various document types. We provide support for invoice reconciliation, bank reconciliation, payment reconciliation, credit card reconciliation, and more.

You can check out details about our pricing on nanonets.com/pricing or talk to us to find the best pricing plan for you.

Here is the detailed documentation for the Nanonets OCR API https://nanonets.com/documentation/